Kitchener Waterloo Market Snapshot August 2025

Friday, September 5th, 2025Waterloo Region Real Estate Market Shows Signs of Stabilization as Interest Rates Hold Steady

“The market is showing signs of stabilization, though we’re seeing a continued cooling trend compared to last year. While sales volumes have only slightly decreased year-over-year, the more notable change is in pricing, with most property types experiencing moderate downward pressure,” says Christal Moura, spokesperson for the Waterloo Region market.

If you are considering to SELL your home or BUY a home in the next short while,

it would be highly beneficial for you to connect with one of our Team Agents at

The Riz Team

Do you want to know what your home is worth today? Click Below for our Online No Obligation Market Evaluation:

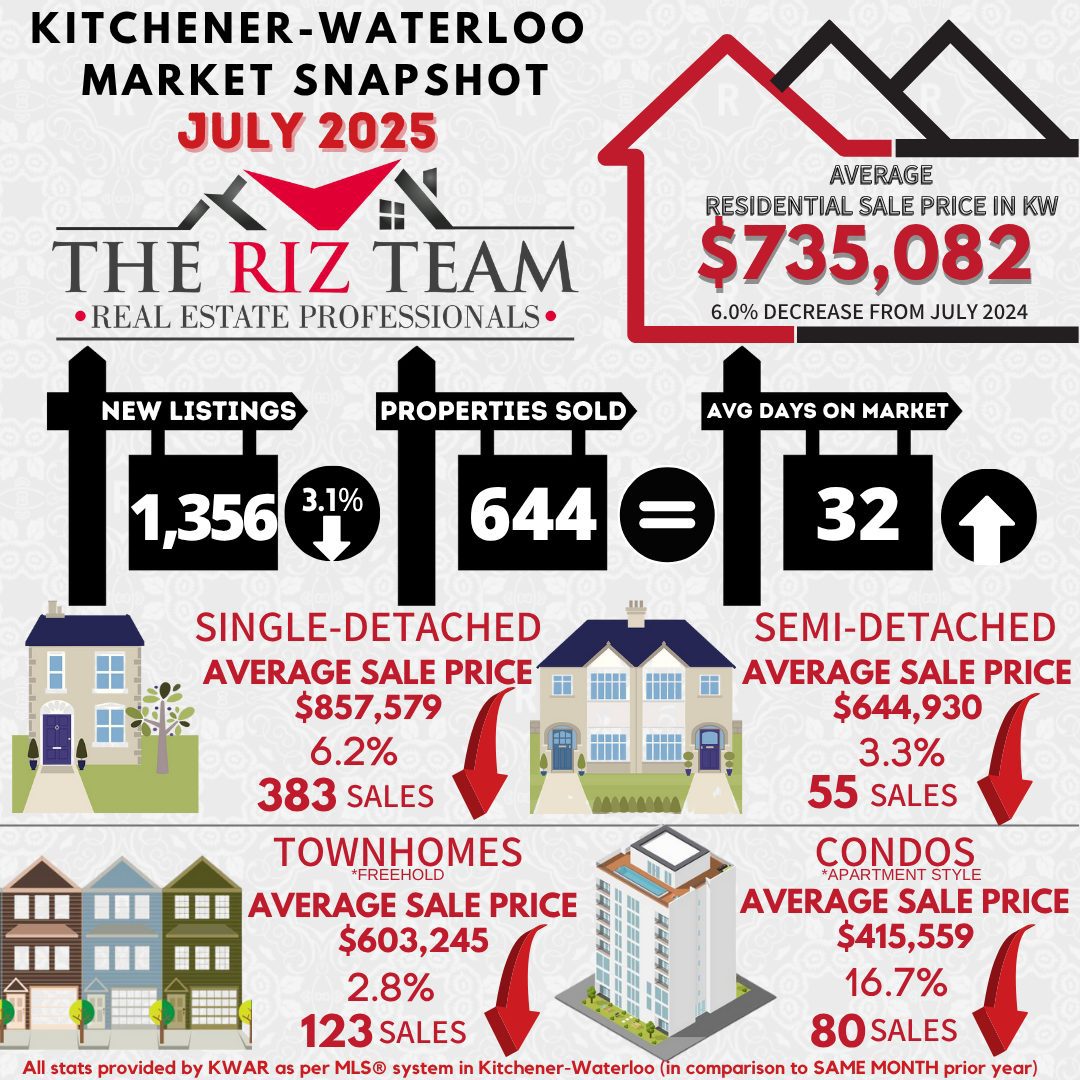

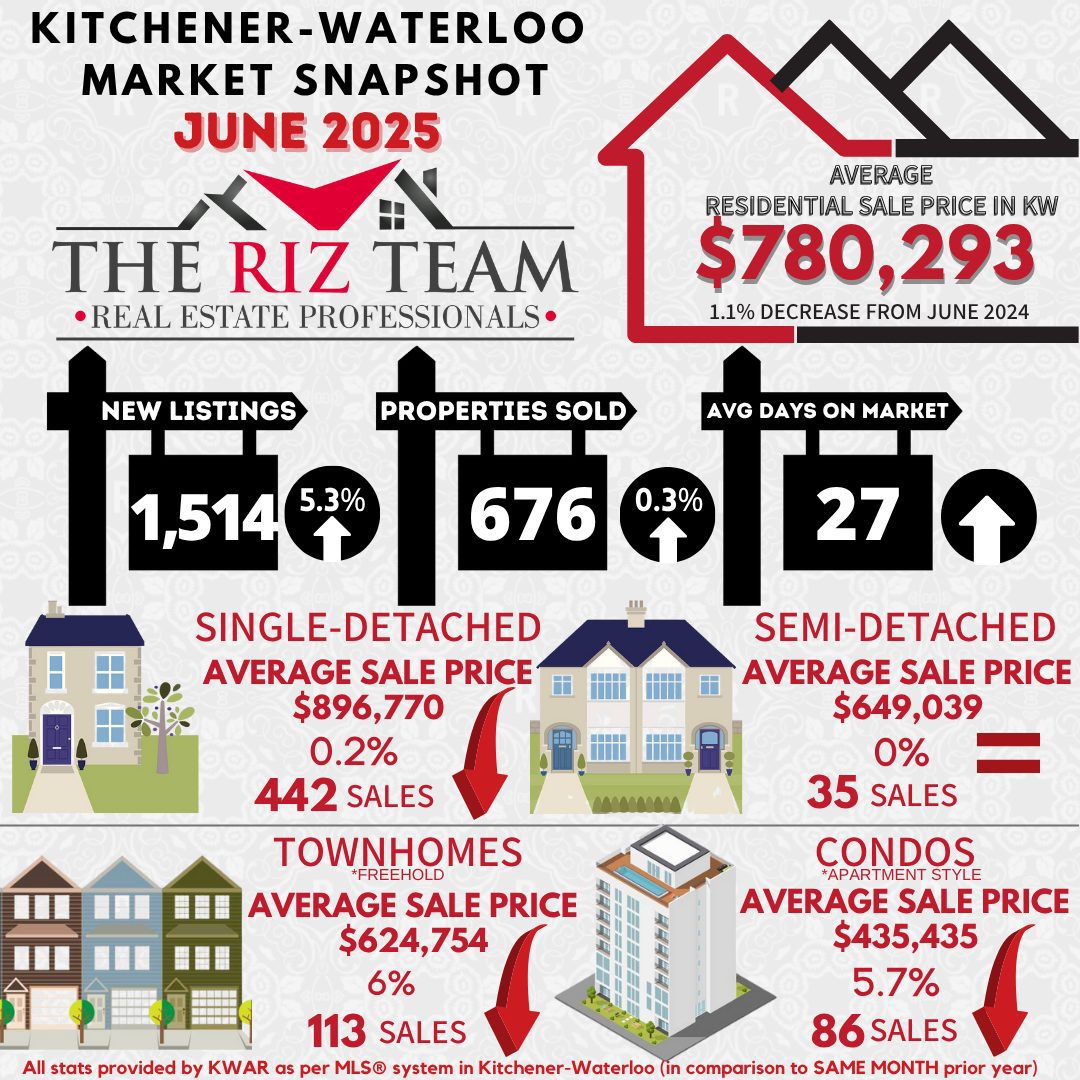

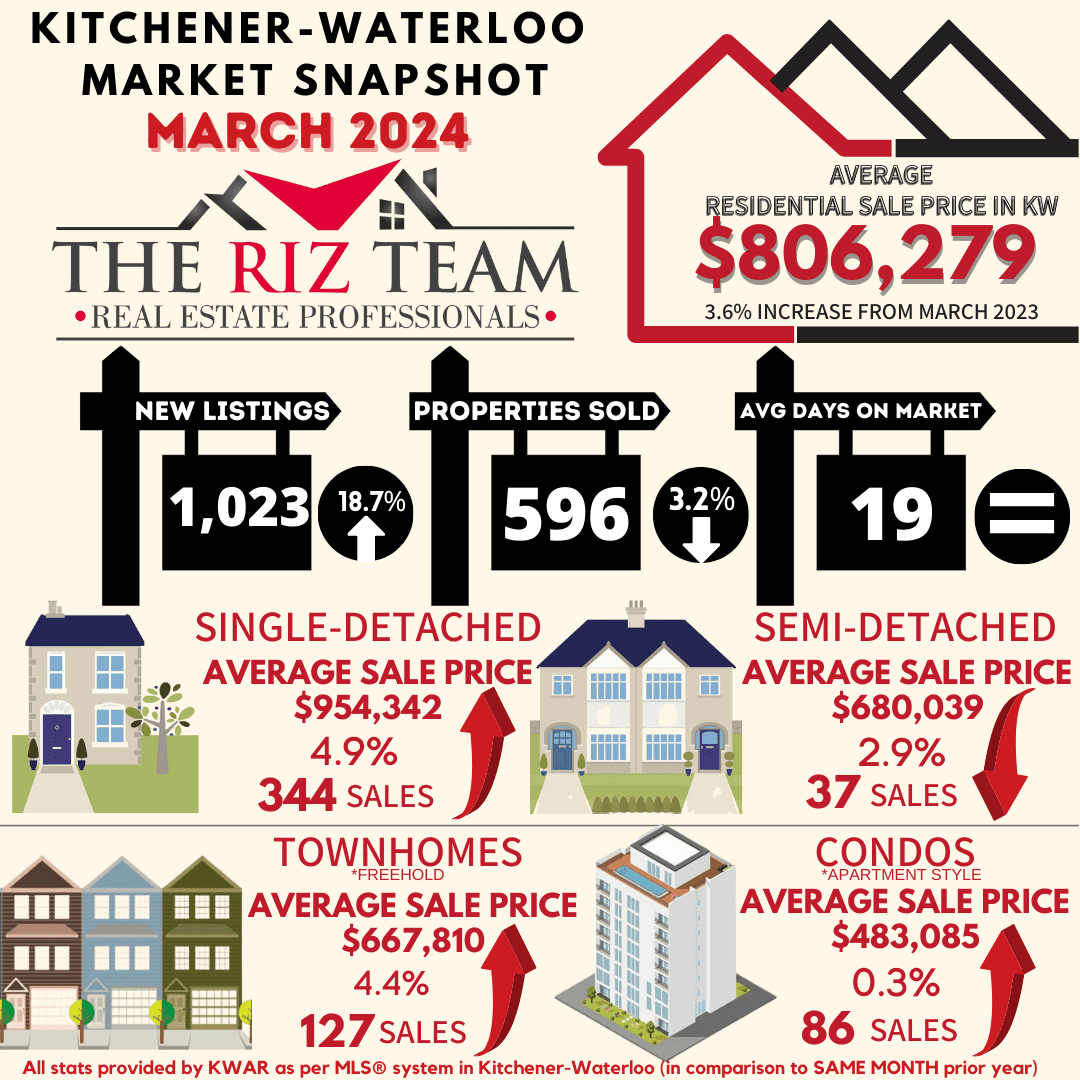

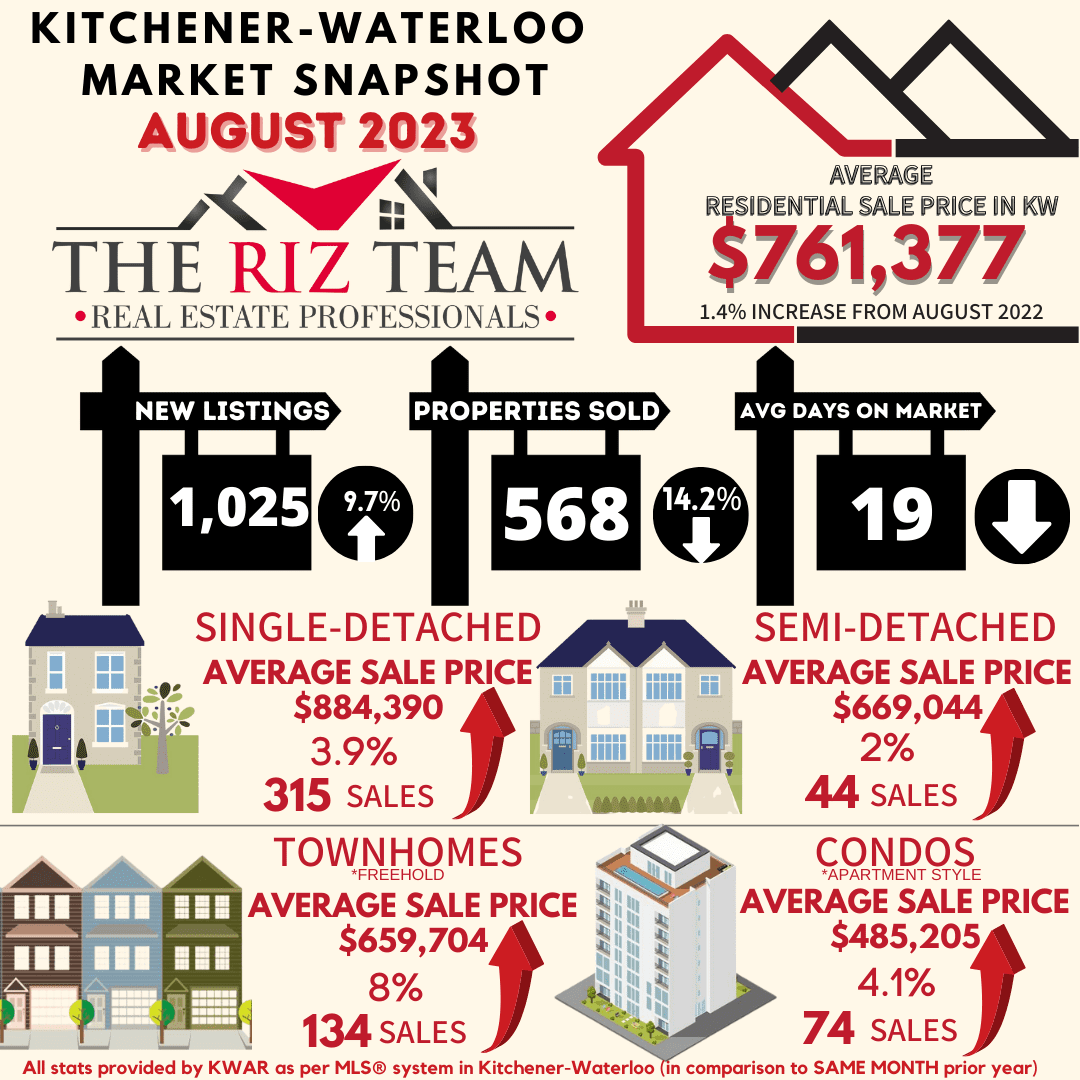

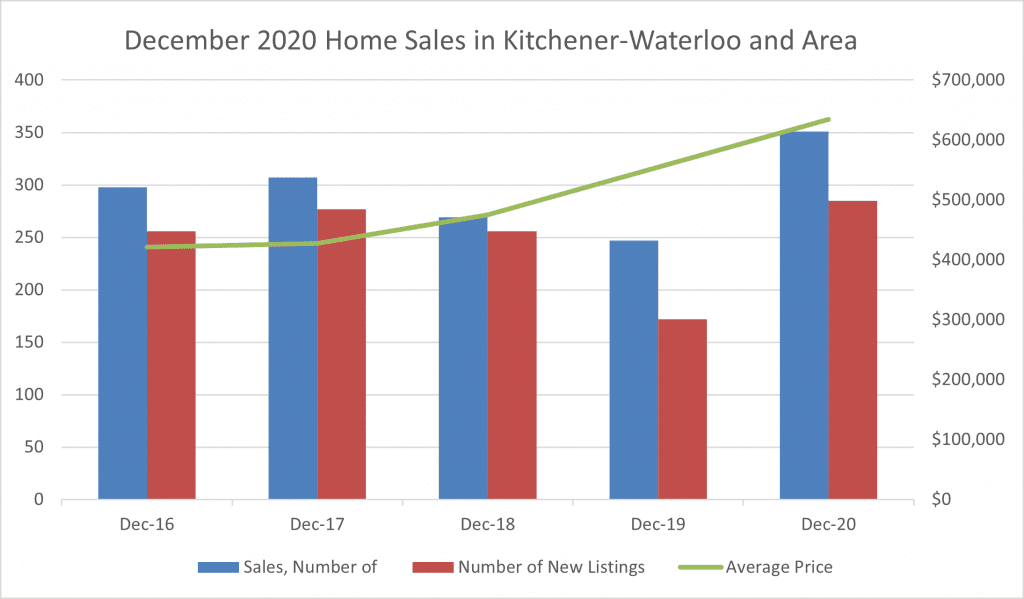

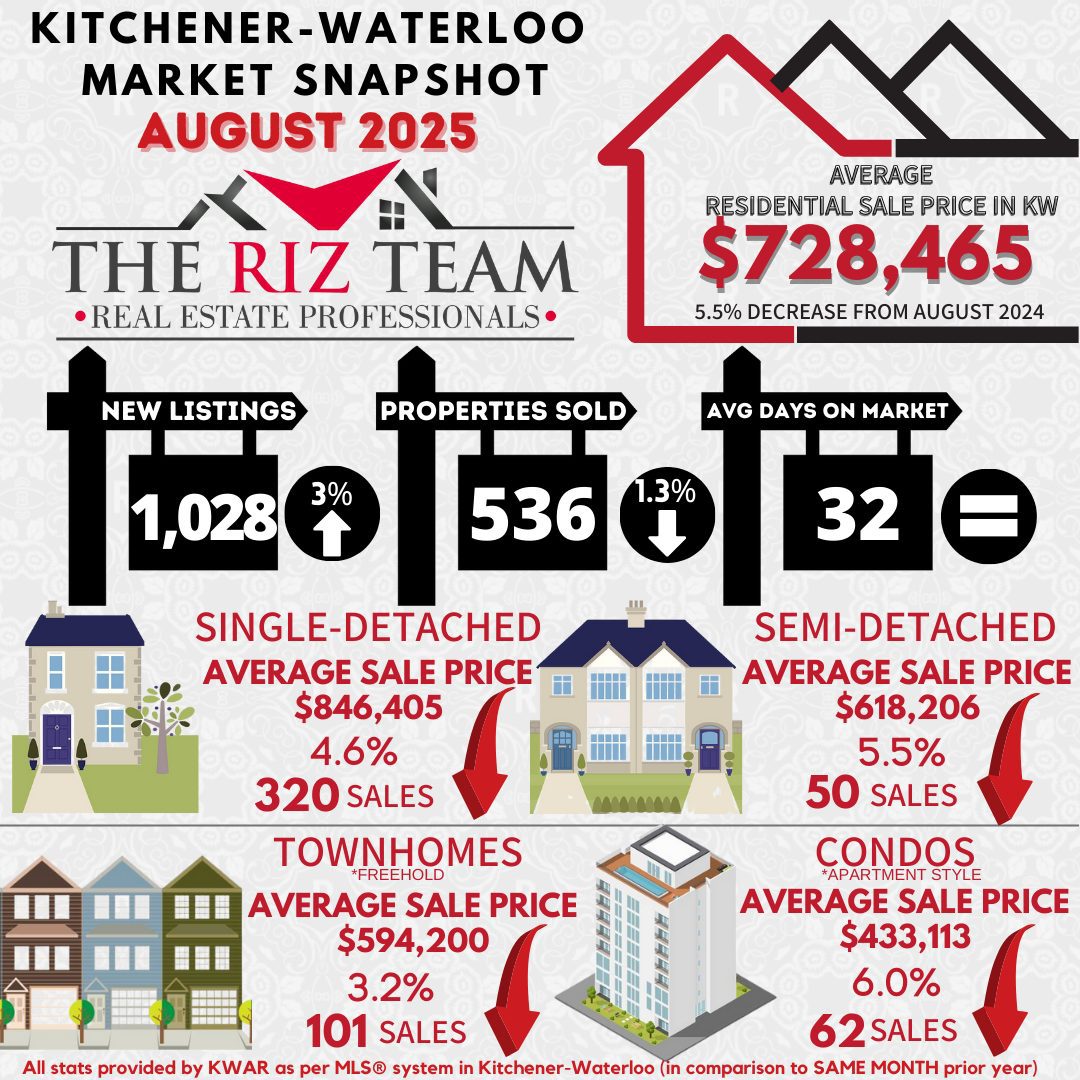

WATERLOO REGION, ON (September 5, 2025) —In August, a total of 536 homes were sold in the Waterloo Region via the Multiple Listing Service® (MLS®) System of the Cornerstone Association of REALTORS® (Cornerstone). This is a decrease of 1.3 per cent compared with the same period last year and a decline of 23.1 per cent compared to the average number of homes sold in the previous ten years for the same month.

Total residential sales in August included 320 detached homes (down 5.6 per cent from August 2024), and 101 townhouses (down 1.0 per cent). Sales also included 62 condominium units (up 1.6 per cent) and 50 semi-detached homes (up 25.0 per cent).

In August, the average sale price for all residential properties in Waterloo Region was $728,465. This represents a 5.5 per cent decrease compared to August 2024 and a 1.0 per cent decrease compared to July 2025.

- The average sale price of a detached home was $846,405. This represents a 4.6 per cent decrease from August 2024 and a decrease of 1.3 per cent compared to July 2025.

- The average sale price for a townhouse was $594,200. This represents a 3.2 percent decrease from August 2024 and a 1.7 percent decrease compared to July 2025.

- The average sale price for an apartment-style condominium was $433,113. This represents a 6.0 per cent decrease from August 2024 and an increase of 4.2 per cent compared to July 2025.

- The average sale price for a semi was $618,206. This represents a 5.5 per cent decrease from August 2024 and a 4.1 per cent decrease compared to July 2025.

CORNERSTONE cautions that average sale price information can help establish long-term trends but does not indicate specific properties have increased or decreased in value. The MLS® Home Price Index (HPI) provides the best way to gauge price trends because averages are strongly distorted by changes in the mix of sales activity from one month to the next.

MLS® Home Price Index Benchmark Price (HPI) |

||||||

| Kitchener-Waterloo | Cambridge | |||||

| Benchmark Type: | August 2025 | Monthly % Change | Yr./Yr. % Change | August 2025 | Monthly % Change | Yr./Yr. % Change |

| Composite | $675,400 | -0.4 | -7.1 | $701,100 | -1.5 | -5.6 |

| Single Family | $795,400 | -0.1 | -5.2 | $742,100 | -1.7 | -4.4 |

| Townhouse | $555,400 | -1.3 | -8.5 | $609,600 | -0.2 | -6.6 |

| Apartment | $409,900 | -0.2 | -7.1 | $455,200 | -0.5 | -5.7 |

There were 1,028 new listings added to the MLS® System in Waterloo Region last month, an increase of 3. per cent compared to August last year and a 11.0 per cent increase compared to the previous ten-year average for August.

The average time to sell a home in August was 32 days, which is the same as the previous month. In August 2024, it took 25 days for a home to sell, and the five-year average was 19 days.

“Despite the softer market conditions, we are encouraged by the healthy increase in new listings, which gives buyers more options,” says Moura. “While our local market statistics indicate signs of stabilization, we are operating in a complex economic environment. The Bank of Canada’s decision to maintain interest rates at 2.75% for the third consecutive time provides some predictability for both buyers and sellers. However, economic uncertainty and the Bank’s focus on inflation, especially regarding shelter costs, remind us that we are in a period where both buyers and sellers need to stay informed and collaborate closely with their REALTOR® to navigate current market conditions.”