Archive for December, 2012

Merry Christmas From The Riz Team

Friday, December 21st, 2012GTA new home sales fall 38%

Thursday, December 20th, 2012November condo sales in the GTA fell 59 per cent from the same month last year

DAVID COOPER/TORONTO STAR

By Susan Pigg | Wed Dec 19 2012While all eyes were looking skyward for fallout from the GTA’s softening condo market in November, sales of new single-family homes plummeted to lows not seen since the recession, as prices soared almost 17 per cent year over year, according to a new study.

Total new home and condo sales to the end of November this year were 16 per cent below the long-term average across the GTA. But the biggest decline — some 38 per cent — has been in the sale of detached, semi-detached and townhouses, according to a report released Wednesday by market research firm RealNet Canada.

Condo sales were down just seven per cent over historic averages for November — although they fell a whopping 59 per cent compared to the same month in 2011, the tail end of what was record year of 28,000 new condo sales across the GTA.

Three new condo launches in particular buoyed highrise sales numbers this November, says RealNet, led by Tridel’s Ten York project in the waterfront area, which is considered an important bellwether of the softening market. Some 85 per cent — 596 of 694 — of its preconstruction units put up for sale Nov. 3 sold within the month, says Tridel vice president Jim Ritchie.

The RealNet study provides some of the best evidence yet of the growing gap between what’s become, just since 2011, the tale of two housing markets across the GTA — new condos and new low-rise homes, which includes detached, semi-detached and townhouses.

The average price of low-rise homes hit a record $625,473 in November, while new condos averaged $437,264, says RealNet.

While the gap between houses and condos has traditionally averaged about $78,000, it has soared to $188,000, largely just in the last 18 months, says George Carras, president of RealNet, which provides new housing market analysis for the Building Industry and Land Development Association (BILD.)

“Sales of low-rise homes in November were the worst on record next to the gloom of November 2008, when we weren’t sure if the world’s financial system was going to hold together or not,” says Carras, citing scarcity for the fact that prices soared to the point that they, combined with tighter mortgage rules, pushed down sales in November.

The scarcity includes a shortage of develop-ready land for new subdivisions caused by a lack of municipal roads, sewers and other infrastructure, as well as the fact that thousands of hectacres of future-growth areas within the provincial greenbelt are tied up in disputes at the Ontario Municipal Board, says Carras.

That supply pressure, at the same time the GTA is seeing a “mini baby boom” among echo boomers, could push up new home prices an average 15 per cent a year, says Bryan Tuckey, president and CEO of BILD.

“In Vancouver, the gap has grown to $700,000 between a condo and a detached house. Vancouver is about 15 years ahead of Toronto in terms of the maturity of its intensification policies and their impacts,” says Carras.

“That city is between the water and the mountains. Here we’re between the water and policy mountains and the same impact is starting to show.”

But John Stillich, former executive director of the Sustainable Urban Development Association, says too many developers remain fixated on the two extremes of new housing — high- and low-rise — instead of a new middle ground of two- or three-storey housing types that allows GTA residents to “live sustainably on the lands that we do have.”

“It’s not about a scarcity of land. It’s about how you use the land. The development industry could probably build twice as many ground-related houses if they started thinking in a completely different way.”

6 Smart Year-end Money Moves

Tuesday, December 18th, 2012The end of every year is a good time to see where you stand financially, and get organized for the coming year

By Krystal Yee December 17, 2012 moneyville.ca

The end of every year is a good time to see where you stand financially, and get organized for the coming year. December is busy with holiday parties and family, but doing a few small things before Jan. 1 could significantly increase your financial success in 2013.

Here are six things to do before the end of the month:

Roll over your vacation days If you didn’t use all of your vacation days, check with your HR department to see how many days you can roll over into 2013. Some companies don’t allow employees to roll over vacation days – so be sure to inquire about cashing out your vacation days instead.

Maximize your extended benefits Insurance deductibles on extended health care plans usually reset on January 1st, so if you haven’t already reached your plan’s annual limit, you might want to renew prescriptions, and schedule any doctor, dentist, optometrist, or supplementary healthcare appointments before the end of the year.

Check your credit score Once a year, Canadians you can get a free credit report from both of the two main credit bureaus in Canada, Equifax and TransUnion. Checking your credit score on an annual basis will help you monitor your financial health, and make sure there aren’t any mistakes on your report that could negatively impact your score.Since Equifax and TransUnion are separate companies, they collect financial information from different sources. That’s why it’s important to receive credit reports from both companies on an annual basis.

Make charitable donations If you haven’t already done so, consider contributing to your favourite charity. Donations must be made by the end of the tax year in which you want to claim the deduction. Anything you donate after December 31 will count toward next year’s deductions.

Related: How to give to charities on a tight budget

Make RRSP and TFSA contributions The money you invest in an RRSP is tax deductible, which means you can claim them as a deduction when you file your tax return. Contributions made to your RRSP on or before March 1, 2013 can be deducted from the previous year’s income tax return.

Use your refund for next year’s contribution or to pay down debt.

Related: 10 end of the year tax saving strategies

Re-balance your investment portfolio Part of any investment plan should be to re-balance your portfolio on a regular basis. Look at re-balancing your portfolio to keep it in inline with your plan.

This will also give you a chance to re-evaluate your priorities. If you plan on getting married, having a child, or buying a home –your investment portfolio might need to change to reflect your new goals.

What year-end money moves will you be making this year?

Real Estate Association Cuts Canadian Home Sales Forecast for 2012 and 2013

Monday, December 17th, 2012The Canadian Real Estate Association is forecasting that house sales will decline two per cent in 2013

The Canadian Press Mon Dec 17 2012 11:49:00

OTTAWA – The Canadian Real Estate Association cut its sales forecast for this year and next on Monday as it said slower sales in the wake of tighter lending rules this summer have remained.

The industry association said now expects home sales this year to slip 0.5 per cent compared with 2011 to about 456,300.

That compared with a forecast in September that called for sales this year to rise 1.9 per cent to 466,900 units.

The association also said it now expects sales next year to drop two per cent to 447,400 compared with earlier expectations for a drop of 1.9 per cent to 457,800 in 2013.

“Annual sales in 2012 reflect a stronger profile prior to recent mortgage rule changes followed by weaker activity following their implementation,” said Gregory Klump, the association’s chief economist.

“By contrast, forecast sales in 2013 reflect an improvement from levels this summer in the immediate wake of mortgage rule changes. Even so, sales in most provinces next year are expected to remain down from levels posted prior to the most recent changes to mortgage regulations.”

Finance Minister Jim Flaherty moved in July to tighten mortgage rules for the fourth time in as many years in order to discourage those most at risk of becoming over-leveraged. Flaherty made mortgage payments more expensive by dropping the maximum amortization period to 25 years.

The association said the average price for 2012 is expected to be $363,900, up 0.3 per cent compared with a September forecast of $365,000, up 0.6 per cent.

For 2013, the association said it expects prices to gain 0.3 per cent to average $365,100. That compared with earlier expectations of a drop of one tenth of one per cent to $364,500 in 2013.

The downgrade for the outlook for the year came as home sales edged down 1.7 per cent month over month in November and were back where they stood in August.

The decrease followed a drop of about one-tenth of a per cent in September.

Actual, or non-seasonally adjusted sales, were down 11.9 per cent from November 2011 while the national average home price in November was $356,687, off 0.8 per cent from November 2011.

Sales were down on a year-over-year basis in three of every four of all local markets in November, including most large urban centres. Calgary stood out as an exception, with sales up 10.6 per cent from a year ago.

Kitchener and Waterloo also recorded a sales increase in November, with sales rising 7.3 per cent. Sales in Cambridge fell 14 per cent.

Toronto, Montreal and Vancouver contributed most to the small decline at the national level.

A total of 432,861 homes have traded hands over the MLS system so far this year, down 0.2 per cent from levels reported over the first 11 months of 2011 and 0.8 per cent below the 10-year average for the period.

The MLS Home Price Index, which is not affected changes in the mix of sales, showed prices up 3.5 per cent nationally on a year-over-year basis in November.

However, it was the seventh consecutive month in which the year-over-year gain shrank and marked the slowest rate of increase since May 2011.

The MLS HPI rose fastest in Regina, up 11.6 per cent year over year in November, though down from 13 per cent in November.

Among other markets, the HPI was up 4.6 per cent year over year in Toronto, 1.9 per cent in Montreal and 7.1 per cent in Calgary. In Greater Vancouver, the HPI was down 1.7 per cent year over year.

Royal LePage Wolle Realty 19th Annual Christmas Classic Results

Friday, December 14th, 20122400 lbs of Food & Over $12,000 in Cash Were Raised to Help The Food Bank of Waterloo Region With its “Christmas Drive”

The more than 60 Sales Representatives of Royal LePage Wolle Realty in Kitchener weighed in with contributions of over 2400 lbs of food and over $12,000 in cash to help the Food Bank with its “Christmas Drive”. More than 900 of the firm’s customers, families and friends filled six theatres at Empire Theatres on December 8th, 2012 for the family-friendly movie “Wreck It Ralph”. The price of admission was at least one non-perishable food item per family member and cash donations were made by appeal to local business. Congratulations to Erin Betts who won our draw for a $250 Gift Certificate for Saucony Shoes.

A special vote of thanks is being extended to the donating corporations, businesses and individuals and thank you to all our clients, families and friends that came out to support us!

5 fun and easy Christmas gift wrapping ideas

Tuesday, December 11th, 2012Get inspired with these simple and pretty Christmas gift wrap ideas.

Photograph Jennifer Bartoli Style at Home Magazine

With the holidays right around the corner, we’ve put together a few fun ideas to easily update your gift wraps this year. From adding small festive treats to the top of a gift to trying new colour combinations, these simple ideas will make Christmas gift wrapping a fun holiday activity.

Add a candy cane A simple red and gold colour palette is always chic and festive but can be a little boring year after year. For an instant update, add a red and pink candy cane to each gift, tightly securing it under the ribbon.

Gift wrap courtesy of Hallmark.

A golden pine cone For smaller gifts, adding a festive item like a pine cone really transforms the look of a gift. For this project, simply spray paint a few pine cones with gold paint. Once they are completely dry, secure to the top of a wrapped gift using a glue gun.

Use a stencil Using craft paper is an inexpensive way to give a rustic feel to your presents. This project was made by using a pretty patterned stencil and lightly dabbing paint to create a fun design. We used a touch of silver and black paint to give a two-toned look. Once the paint has completely dried, add a bright ribbon and a personalized gift tag.

Tip: Depending on the size of the gift, it may be easier to apply the stencil once you have already wrapped your gift. You can then decide exactly where you want the pattern to go.

Try a new colour palette Switching up your usual Christmas colour palette is the easiest way to update you holiday style. We particularly love the silver and blue combination: it’s still festive, but has an understated, sophisticated feel. For this look, we paired silver wrapping paper adorned with blue, white and maroon snowflakes and used a thick fabric ribbon tied in a simple knot.

Make it personal If you don’t have a set of gift tags on hand, adding the name of the recipient of your gift directly on the paper can look lovely too. For this project, use matte wrapping paper making sure that paint will adhere to the paper. We used craft paper with a simple thick black ribbon. Using an alphabet stencil, simply dab coloured paint to spell a name.

Tip: Try to tightly secure the stencil while you are using so that letters do not smudge.If you’re not used to using stencils, practice on a scrap piece of wrapping paper before printing a name on an already wrapped gift.

Residential Sales up in November

Wednesday, December 5th, 2012By Kitchener-Waterloo Association of REALTORS® (KWAR) admin •December 5th, 2012

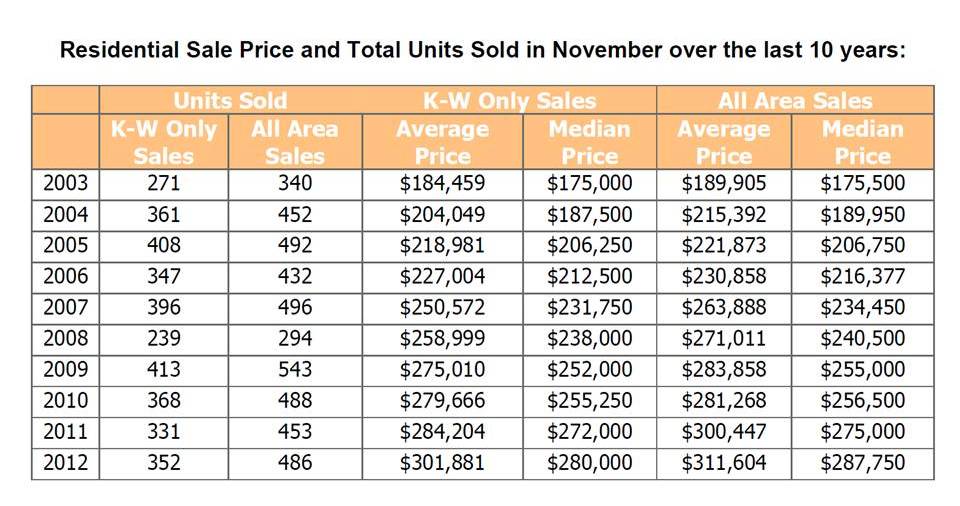

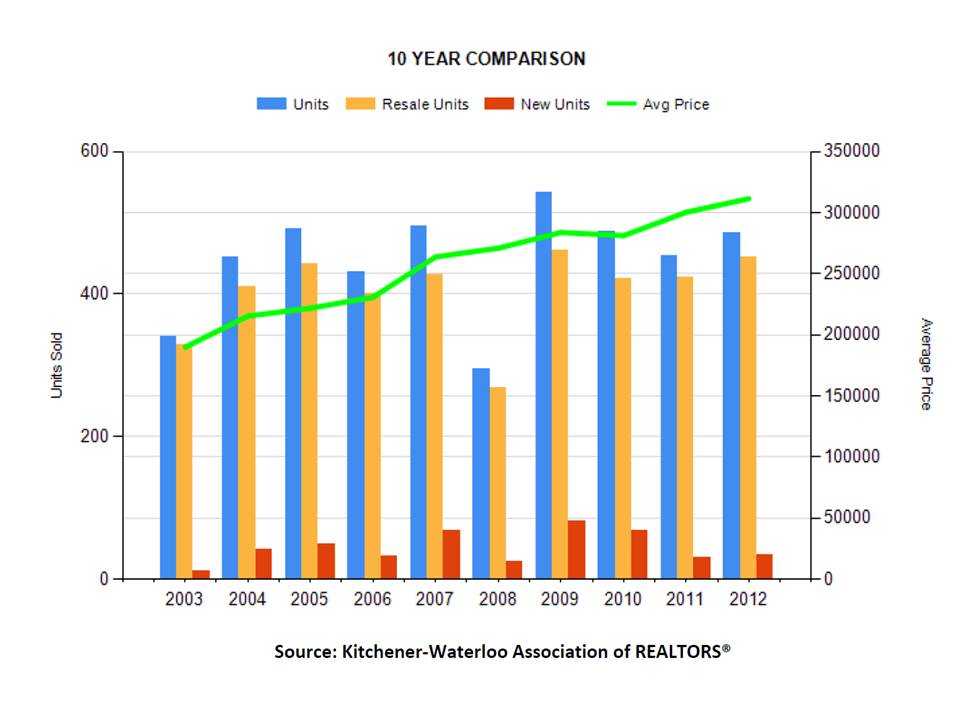

KITCHENER-WATERLOO, ON (November 5, 2012) –– Residential real estate sales through the Multiple Listing System (MLS®) of the Kitchener-Waterloo Association of REALTORS® (KWAR) were up 7.3 percent last month compared to November of last year.

There were 486 residential properties sold in November, bringing the year-to-date total to 5,931, just nine more home sales than during the first 11 months of 2011. The total value of homes sold last month was $151 million, up 11.3 percent over last year.

“In terms of total unit sales, it was a better than average November” says Dietmar Sommerfeld, president of the KWAR. “Our figures show that residential transactions in November were 6.8 percent above the previous 5 year-average.”

November’s residential sales included 318 detached homes (up 8.9 percent), 33 semi-detached (down 17.5 percent), 26 townhouses (up 4 percent), and 103 condominium units (up 14.4 percent).

There was a jump in the number of home selling in the $500,000 to $750,000 price range — 41 homes compared to 23 in November of last year. This put some upward pressure on the average price range.

The average sale price of all homes sold in November was $311,604, compared with $300,447 a year ago, an increase of 3.7 percent. Single detached homes sold for an average price of $359,439, compared with 346,044 last year, up 3.9 percent.

The median price for all homes sold in November was $287,750 compared with $275,000, an increase of 4.6 percent. Single detached homes sold for a median price of $326,500 compared with $315,000 last year, up 3.7 percent.

Sommerfeld says that despite talk of cooling markets in some Canadian cities, continued low borrowing costs, confidence in the local real estate market, and a well-diversified local economy are keeping Kitchener-Waterloo’s housing market steady and stable.