Kitchener Market Snapshot for June 2020

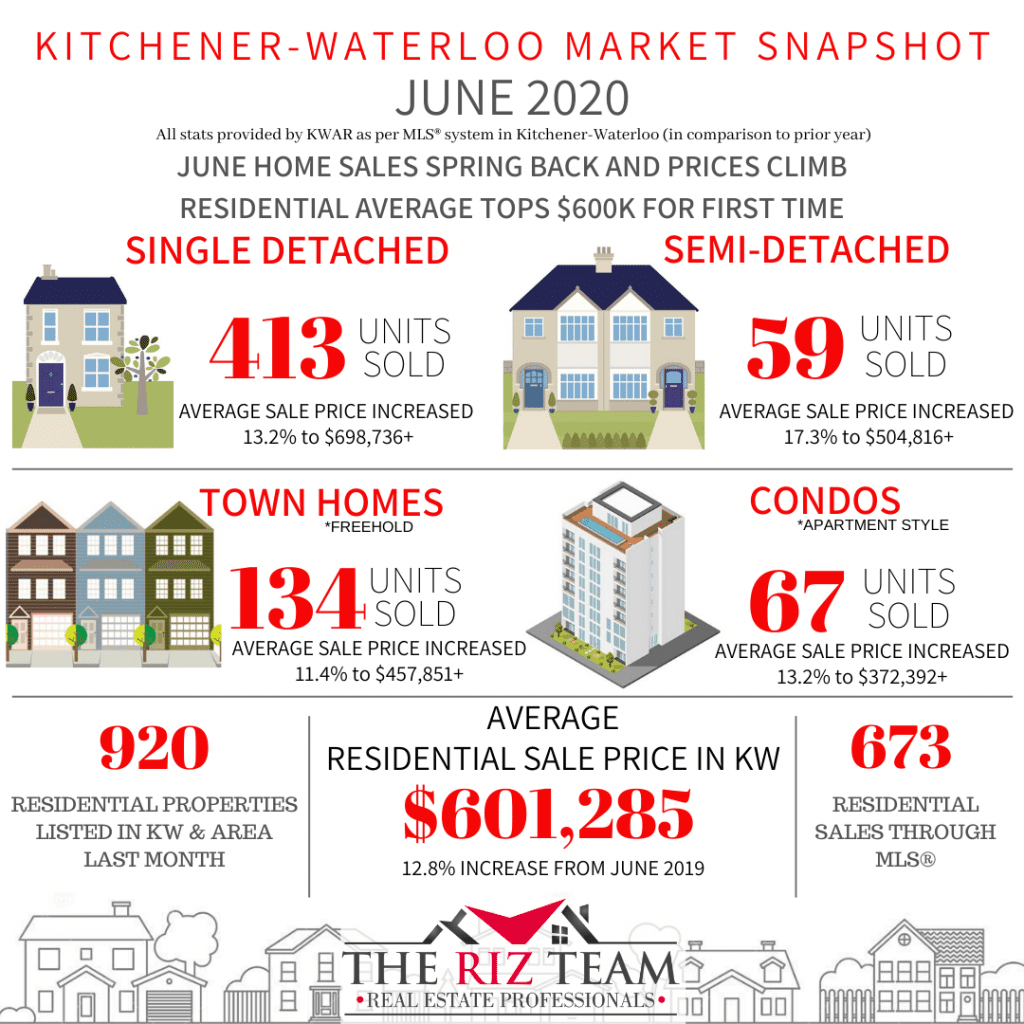

Tuesday, July 7th, 2020JUNE HOME SALES SPRING BACK AND PRICES CLIMB

RESIDENTIAL AVERAGE TOPS $600K FOR FIRST TIME

KITCHENER-WATERLOO, ON (July 6, 2020) ––The number of homes sold in June shot up 57.6 per cent compared to May. There were 673 residential homes sold through the Multiple Listing System (MLS® System) of the Kitchener-Waterloo Association of REALTORS® in June 2020, an increase of 2.1 per cent compared to June 2019, and an increase of 8.5 per cent compared to the previous 10-year average for June.

“After a pandemic-induced delay to the typical spring market, home sales sprung back to life in a big way in June,” said Colleen Koehler, President of KWAR. “As Waterloo region entered stage two of reopening, we saw many buyers and sellers resuming their home buying and selling plans.”

Total residential sales in June included 413 detached homes (up 1.7 per cent from June 2019), and 67 condominium apartments (up 36.7 per cent). Sales also included 134 townhouses (down 15.7 per cent) and 59 semi-detached homes (up 31.1 per cent).

Total residential sales during this second quarter (April, May, June) are down 33 per cent compared to last year. On a year-to-date basis, they are down 15.6 per cent.

“I expect for the remainder of 2020 will see the number of home sales returning to near historical levels,” says Koehler. “There will be some catching up to do in the coming weeks, but I don’t think you will see the market taking a hiatus this summer.”

The average sale price of all residential properties sold in June increased 12.8 per cent to $601,285 compared to the same month last year, while detached homes sold for an average price of $698,736 an increase of 13.2 per cent. During this same period, the average sale price for an apartment-style condominium was $372,392 for an increase of 13.2 per cent. Townhomes and semis sold for an average of $457,851 (up 11.4 per cent) and $504,816 (up 17.3 per cent) respectively.

The median price of all residential properties sold in June increased 14.4 per cent to $564,000 and the median price of a detached home during the same period increased 11.9 per cent to $650,000.

There were 920 new listings added to the MLS® System in KW and area last month, the most added in a single month since May of last year, and 1.9 per cent more than the previous ten-year average for June.

The total number of homes available for sale in active status at the end of June was 640, a decrease of 28.7 per cent compared to June of last year.

The number of Months Supply (also known as absorption rate) continues to be very low at just 1.4 months for the month of June, 22.2 per cent below the same period last year. The previous ten-year average supply of homes for June was 3.22 months, and in the past 5 years, the average supply for June was 2.22 months.

The average days to sell in June was 16 days, compared to 20 days in June 2019.

Koehler notes real estate was deemed an essential service from the beginning of the lockdown and REALTORS® have been taking all the necessary precautions to ensure transactions are done safely. KWAR’s president advises consumers to talk to their Realtor® about what measures they will be taking to protect your health and safety as they help you on your real estate journey.

Historical Sales By Property Type

Months Supply of Homes For Sale

Historical Median Sales Price – By Property Type

Historical Average Sales Price – By Property Type