Bank of Canada makes second consecutive rate cut, lowers overnight lending rate to 4.50%

Wednesday, July 24th, 2024This decrease will assist buyers by offering a better affordability plan on their monthly payments, while also helping sellers within a more active marketplace as buyers start to re-enter. Be sure to connect with anyone from The Riz Team and let’s put a plan in place for your next move….

Do you want to know what your home is worth today? Click Below for our Online No Obligation Market Evaluation

Bank of Canada cuts key interest rate again, more cuts ‘reasonable’ if inflation keeps easing

For the second time in a row, Canada’s central bank has cut its overnight lending rate.

In its pre-scheduled July 2024 announcement, the Bank of Canada dropped the target for the overnight lending rate by 25 basis points to 4.50%.

While inflation remains above the Bank’s 2% target, it is expected that inflation will continue to ease as the global economy expands into 2026, bolstering the Bank’s decision to continue lowering rates.

In his opening remarks to reporters at a press conference following the announcement, Tiff Macklem, Governor of the Bank of Canada, cited that the risk that inflation continues to grow must be balanced against the risk that the economy and inflation could weaken.

“Looking ahead, we expect inflation to moderate further, though progress over the next year will likely be uneven. This forecast reflects the opposing forces affecting inflation. The overall weakness in the economy is pulling inflation down. At the same time, price pressures in shelter and some other services are holding inflation up,” said Macklem. “We are increasingly confident that the ingredients to bring inflation back to target are in place. But the push-pull of these opposing forces means the decline in inflation will likely be gradual, and there could be setbacks along the way.”

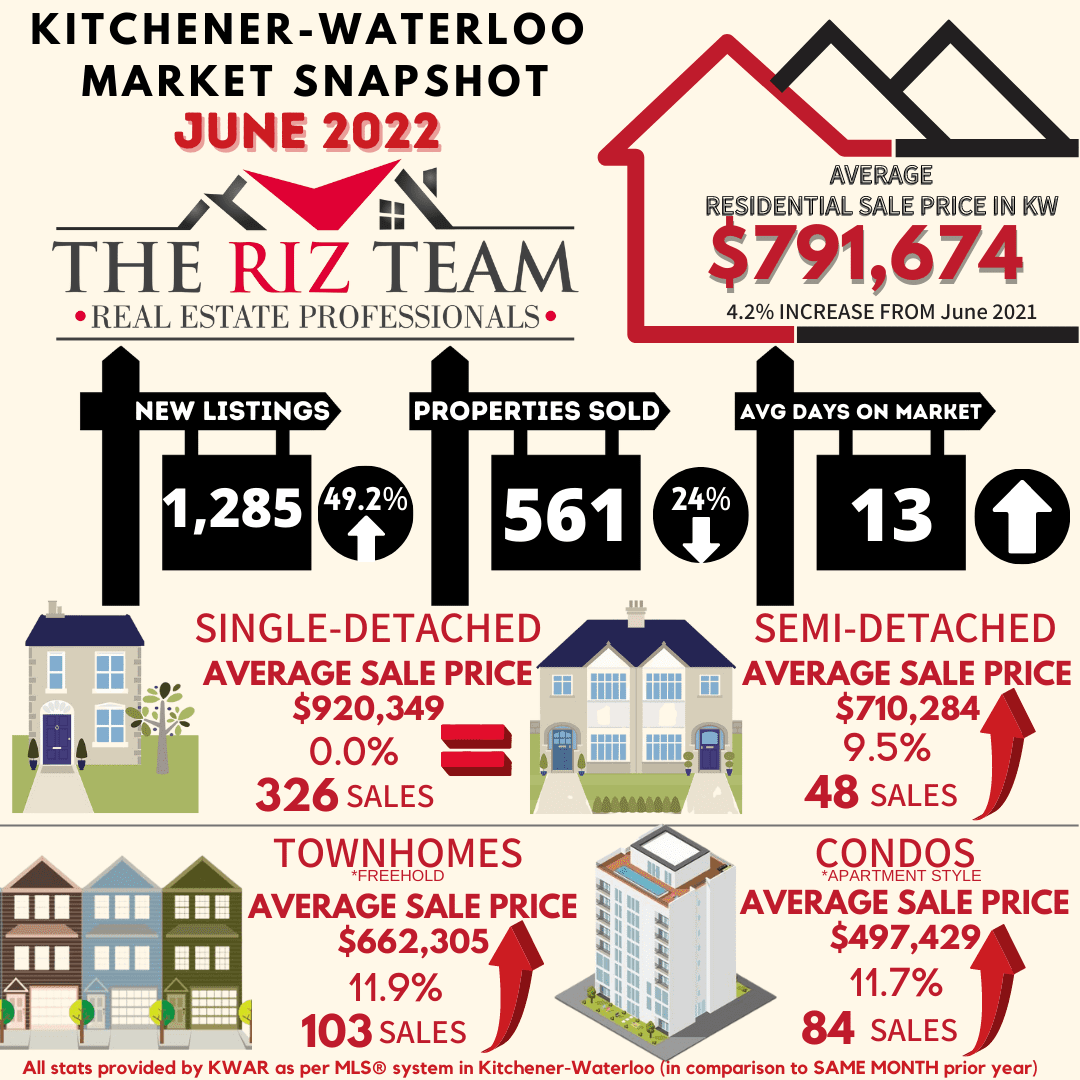

| Date* | Target (%) | Change (%) |

| July 24, 2024 | 4.5 | -0.25 |

| June 5, 2024 | 4.75 | -0.25 |

| April 10, 2024 | 5 | — |

| March 6, 2024 | 5 | — |

| January 24, 2024 | 5 | — |

| December 6, 2023 | 5 | — |

| October 25, 2023 | 5 | — |

| September 6, 2023 | 5 | — |

| July 12, 2023 | 5 | 0.25 |

| June 7, 2023 | 4.75 | 0.25 |

| April 12, 2023 | 4.5 | — |

| March 8, 2023 | 4.5 | — |

According to a recent Royal LePage survey, conducted by Leger,1 51% of Canadians who put their home buying plans on hold the last two years said they would return to the market when the Bank of Canada reduced its key lending rate. Eighteen percent said they would wait for a cut of 50 to 100 basis points, and 23% said they’d need to see a cut of more than 100 basis points before considering resuming their search.

“Our research shows that many buyer hopefuls have been waiting for a concrete signal from the Bank of Canada that the economy is moving in the right direction. A second cut to the overnight lending rate indicates just that, and with mortgage qualification thresholds continuing to come down, sidelined buyers may have the confidence they need to make their return to the housing market,” said Karen Yolevski, COO of Royal LePage Real Estate Services Ltd.

“We expect this will prompt a slight boost in activity in the short-term, followed by more robust buyer demand in the fall. In the meantime, some much-needed inventory has been building in major markets over the last few months, giving buyers more options to choose from. In addition to lower rates, this may also encourage more buyers to re-enter the market in the near future.”

The Bank of Canada will make its next announcement on Wednesday, September 4th.

Read the full July 24th report here.

Article excerpts brought to you by

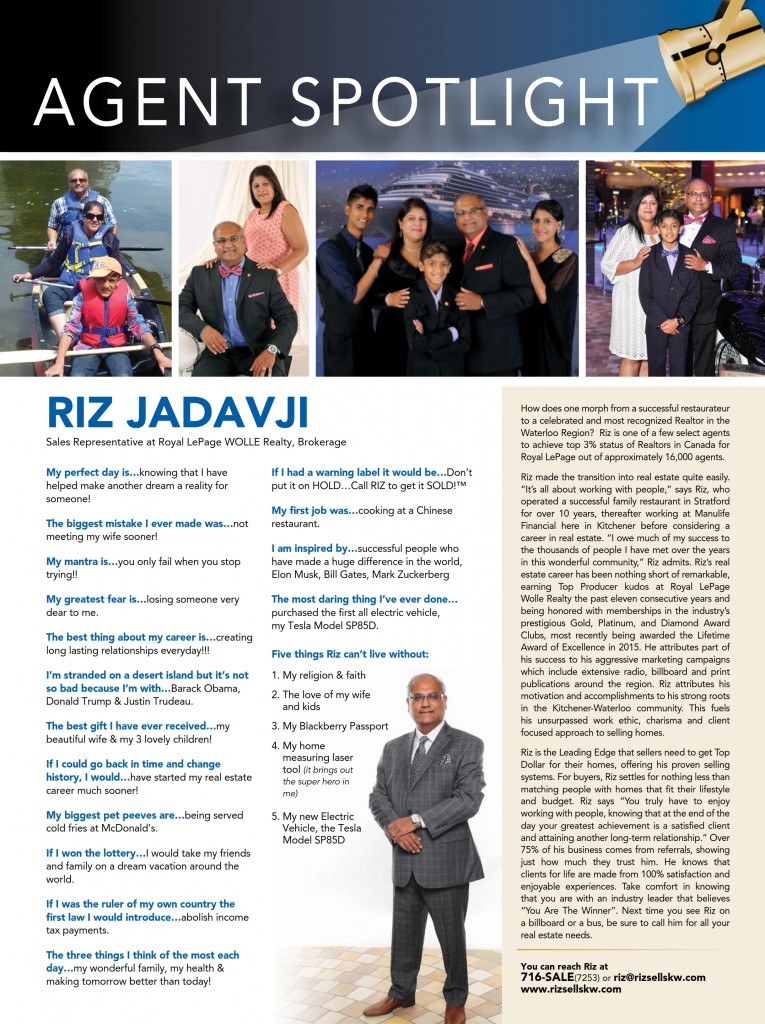

Michelle McNally

Communications manager, Royal LePage