Real Estate Association Cuts Canadian Home Sales Forecast for 2012 and 2013

Monday, December 17th, 2012The Canadian Real Estate Association is forecasting that house sales will decline two per cent in 2013

The Canadian Press Mon Dec 17 2012 11:49:00

OTTAWA – The Canadian Real Estate Association cut its sales forecast for this year and next on Monday as it said slower sales in the wake of tighter lending rules this summer have remained.

The industry association said now expects home sales this year to slip 0.5 per cent compared with 2011 to about 456,300.

That compared with a forecast in September that called for sales this year to rise 1.9 per cent to 466,900 units.

The association also said it now expects sales next year to drop two per cent to 447,400 compared with earlier expectations for a drop of 1.9 per cent to 457,800 in 2013.

“Annual sales in 2012 reflect a stronger profile prior to recent mortgage rule changes followed by weaker activity following their implementation,” said Gregory Klump, the association’s chief economist.

“By contrast, forecast sales in 2013 reflect an improvement from levels this summer in the immediate wake of mortgage rule changes. Even so, sales in most provinces next year are expected to remain down from levels posted prior to the most recent changes to mortgage regulations.”

Finance Minister Jim Flaherty moved in July to tighten mortgage rules for the fourth time in as many years in order to discourage those most at risk of becoming over-leveraged. Flaherty made mortgage payments more expensive by dropping the maximum amortization period to 25 years.

The association said the average price for 2012 is expected to be $363,900, up 0.3 per cent compared with a September forecast of $365,000, up 0.6 per cent.

For 2013, the association said it expects prices to gain 0.3 per cent to average $365,100. That compared with earlier expectations of a drop of one tenth of one per cent to $364,500 in 2013.

The downgrade for the outlook for the year came as home sales edged down 1.7 per cent month over month in November and were back where they stood in August.

The decrease followed a drop of about one-tenth of a per cent in September.

Actual, or non-seasonally adjusted sales, were down 11.9 per cent from November 2011 while the national average home price in November was $356,687, off 0.8 per cent from November 2011.

Sales were down on a year-over-year basis in three of every four of all local markets in November, including most large urban centres. Calgary stood out as an exception, with sales up 10.6 per cent from a year ago.

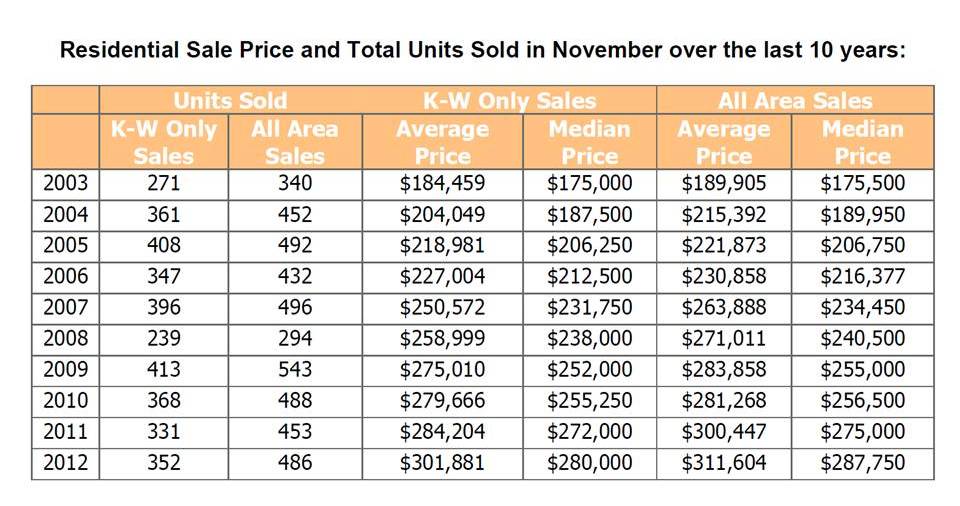

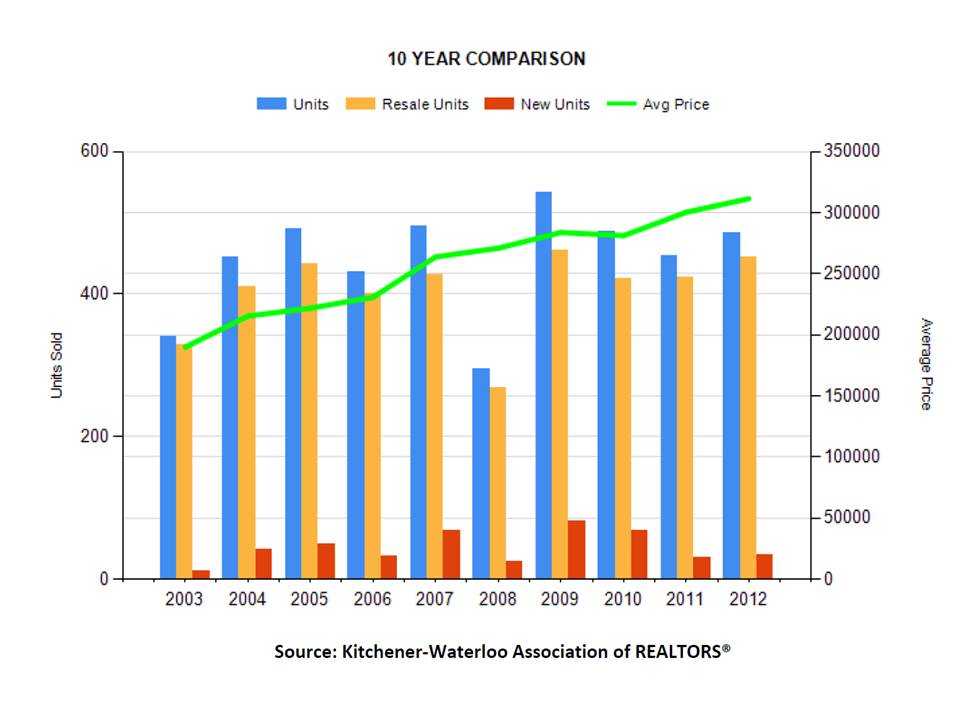

Kitchener and Waterloo also recorded a sales increase in November, with sales rising 7.3 per cent. Sales in Cambridge fell 14 per cent.

Toronto, Montreal and Vancouver contributed most to the small decline at the national level.

A total of 432,861 homes have traded hands over the MLS system so far this year, down 0.2 per cent from levels reported over the first 11 months of 2011 and 0.8 per cent below the 10-year average for the period.

The MLS Home Price Index, which is not affected changes in the mix of sales, showed prices up 3.5 per cent nationally on a year-over-year basis in November.

However, it was the seventh consecutive month in which the year-over-year gain shrank and marked the slowest rate of increase since May 2011.

The MLS HPI rose fastest in Regina, up 11.6 per cent year over year in November, though down from 13 per cent in November.

Among other markets, the HPI was up 4.6 per cent year over year in Toronto, 1.9 per cent in Montreal and 7.1 per cent in Calgary. In Greater Vancouver, the HPI was down 1.7 per cent year over year.