Kitchener-Waterloo Home Sales Maintain Steady Pace

February 7th, 2013By Kitchener-Waterloo Association of REALTORS® (KWAR) admin •February 6th, 2013

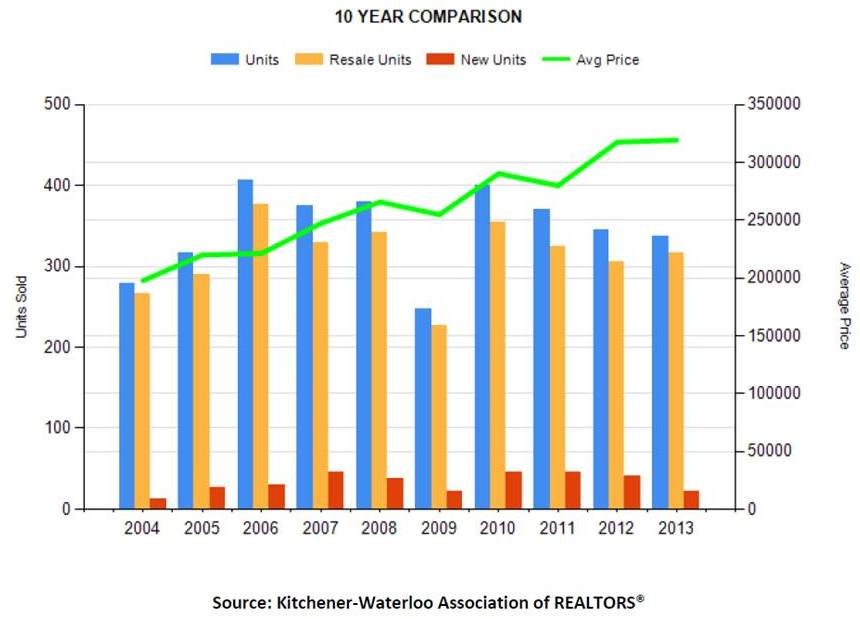

KITCHENER-WATERLOO, ON (February 5, 2013) –– Residential sales through the Multiple Listing Service (MLS® System) of the Kitchener-Waterloo Association of REALTORS® (KWAR) were down slightly in January compared to the same month last year.

There were a total of 337 residential properties sold last month, a 2.3 percent decrease compared to the same month last year, and a 23.9 percent increase from December 2012.

“January’s sales were in line with the 10-year average for our area,” Dietmar Sommerfeld, President of the KWAR points out.

January’s residential sales included 237 detached homes (up 6.8 percent compared to January 2012) 49 condos (down 34.7 percent), 24 semis (up 14.3 percent), and 26 freehold townhouses (up 4 percent).

Residential sales between $250 and $349,999 were strong showing a 32 percent (157 vs. 119 units) increase compared to January last year.

The average sale price of all homes sold in January increased half a percent to $319,283 from the same time last year. Single detached homes sold for an average price of $354,540, a decrease of 2.6 percent compared to January 2012. In the condominium market the average sale price in January was $212,408, a 4.7 percent decrease compared to the same month a year ago.

The KWAR cautions average sale price information can be useful in establishing long term trends, but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is based on the total dollar volume of all residential properties sold.

Consumers uncertain about current market conditions should work with a REALTOR® to develop an effective selling strategy. If you are buying, a REALTOR® will negotiate on your behalf and guide you through every step. A REALTOR® understands the local market and must, by law, look after your best interests.

Buyer beware the ‘as is’ clause

January 25th, 2013The “as is” condition might mean the homeowner does not have the time or money to make repairs, or in the case of a foreclosure or estate sale, the seller may not be familiar with the condition of the house.

By Joe Richer | Fri Jan 25 2013 | moneyville.ca

Q: What do I need to know about buying a home listed in “as is” condition?

A: When a home is listed for sale “as is,” it doesn’t necessarily mean that it is in a poor state of repair. The term simply means the property is being sold in its current condition and the seller will not be making any repairs to complete the sale.

The “as is” condition might mean the homeowner does not have the time or money to make repairs, or in the case of a foreclosure or estate sale, the seller may not be familiar with the condition of the house.

Whatever the reason, if you’re interested in the property, the only way to know the true condition is to have a home inspection carried out. Consider including a contingency clause in your offer based on your satisfaction with the inspection. If a deficiency with a budget-busting repair cost is uncovered during the inspection, you’ll want the option to walk away without penalty.

The advantage of an as is sale is the purchase price may be comparatively lower than similar properties in the neighbourhood. But be sure to factor in the cost of repairs and renovations when accounting for the total cost of the purchase.

Buying as is isn’t for everyone. If you’re planning to ask the owner to address a defect or are unwilling to follow-through on the purchase if the inspector finds anything wrong, you’re probably best to avoid making an offer on an as is property.

If you have a question for Joe, email askjoe@reco.on.ca. Joseph Richer is RECO’s registrar and is in charge of the administration and enforcement of all rules under the Real Estate and Business Brokers Act. You can find more tips at reco.on.ca, follow on Twitter @RECOhelps or on YouTube at youtube.com/recohelps.

Why more home sellers are listing in January

January 11th, 2013With an uncertain housing market, more homeowners are opting to put their houses on the market in January. Here are some tips for buyers and sellers to negotiate a safe and successful winter home sale!

By Mark Weisleder | Fri Jan 11 2013| moneyville.ca

January is a slow month for real estate as most sellers choose to wait until the middle of February in the hopes of capitalizing on the early spring market. However, given the uncertainty in the housing market right now, more sellers are opting to put their house on the market in January.

This presents an opportunity for buyers. Most people are reluctant to uproot their families during the school year, so that means less competition — and fewer bidding wars. Lenders will not be as busy, so buyers can expect a more efficient process to get approved for a mortgage to ensure they have financing in place before making an offer.

But there are things you simply won’t be able to inspect during the winter. Here are some tips for protecting yourself when making a deal during the winter months:

Sellers

Spruce up the outside: Use urns with light wood branches to brighten up the exterior of your home, to compensate for any overcast day or snow on the ground.

Get rid of the Christmas lights: homes that look dated on the outside give the impression that they are probably dated on the inside.

Make sure your fireplace is working during any showing, that the temperature is comfortable in the home and that any interior lighting compensates for what is usually grey lighting from outside.

Have pictures of your landscaping available from the summer and autumn, showing how beautiful your home looks year round.

Have available any inspections that you may have done on your air-conditioning unit or swimming pool before they were closed for the winter, as buyers will likely not be able to conduct inspections on these items and will have questions.

Consider inviting a company to do an environmental audit on your home in advance, confirming that there is no moisture behind the walls that could lead to mould and that you have sufficient insulation behind the walls.

Buyers

If there is anything that cannot be inspected because of the winter, such as the air-conditioning system or any swimming pool, then negotiate an extended warranty in the agreement, to give you until at least May 1, to inspect and have the seller be responsible for any damages. In addition, also negotiate a holdback of, say, $2,000 so that if a problem arises, the money comes out of that fund to fix it and you don’t have to chase the seller in court later.

Be careful about snow accumulating around the base of the home. It will be difficult for a home inspector to figure out whether the grading is likely to cause water problems in the basement later. Consider doing your own environmental audit to check for moisture behind any walls.

If the snow on the roof looks like it is evaporating faster than the snow around the house, it is likely a sign that there is not enough insulation in the home.

Check with your insurance company early as to whether you will have any difficulty obtaining insurance on the home; for example, by finding out whether there have been claims made in the neighbourhood about water damages or sewage backups.

Check whether snow accumulation makes it more difficult for street parking, as this may be the only parking available on certain streets. Also see how bad weather may affect your morning commute.

Check the last electric/gas bills, to determine how energy efficient the home is in winter.

People tend to hibernate and stay at home in the winter, so take the opportunity to get to know the neighbours before you finalize your purchase.

By being properly prepared in advance, buyers and sellers can negotiate a safe and successful winter home sale.

Read more stories from Mark Weisleder: click here.

Mark Weisleder is a Toronto real estate lawyer. Contact him at mark@markweisleder.com

How to Flu-Proof Your Home

January 10th, 2013Show winter illnesses the door by keeping the house as germ-free as can be. This Old House has some time-honored tips for making your house a healthy home.

Jeanne Baron • This Old House online

Protection Begins at Home

As the official influenza season begins—and fears about swine flu ramp up—it’s important to find ways to keep winter’s ever-present illness at bay. That’s especially true this year, as one in every 20 outpatient doctor visits will be for the flu, as influenza is commonly known—twice what it is in an average year.

But dealing with the virus that causes the flu can be tricky. Health officials recommend getting a yearly flu vaccine, and they urge everyone to protect themselves with one time-honored tactic: wash your hands, well and often. That may be the single best way to stop the disease in its tracks.

But in case you find yourself facing an encroaching onslaught of the illness though coworkers or school-age kids, This Old House has a few strategies to make life as hard as possible for the flu—or any germs, for that matter—to take root in your house.

Watch Out for Germy Hot Spots

The sink, the telephone, children’s toys, and doorknobs are popular landing sites for virus and bacteria. If someone is sick at home, disinfect daily, especially the remote control and the phone. Charles Gerba, microbiologist and author of The Germ Freak’s Guide to Outwitting Colds and Flu, says remote controls and countertops can be the germiest locale in the whole house. “What’s the first thing you do after you call in sick? Pick up the remote control,” he says. “Sixty percent of them contain influenza virus in the home of a sick person.”

In fact, Gerba says, remote controls are the germiest thing in hotel and hospital rooms. And since a virus like influenza spreads through touching something a sick person has also touched, or an object that’s been sneezed on, cleaning off the places your hand usually goes is most important.

Find out more from Health.com about the germiest places you’re likely to encounter during an average day.

Disinfect the Desk

According to Gerba, the home office is another place to watch out for germs. “Desktops have 400 times more bacteria than a toilet seat,” he says.

Gerba says to disinfect your desktop weekly, along with the rest of the house. This could reduce your exposure to colds and flu by as much as 50 percent.

Don’t Forget the Sponge

Your kitchen sponge should be replaced every couple of weeks. If that runs counter to your frugal ways, you can microwave it for one minute or run it in the dishwasher to eliminate germs.

Stop Pushing Germs Around

Beware of dust rags, dishrags, mops and other cleaning tools. Unless sanitized between uses, they only spread around the germs you are trying to kill. “It’s a free ride for the virus,” says Gerba. Some of the cleanest houses he’s tested had the highest germ counts. And get this: a few untidy bachelor pads tested very low for germs, which he attributes to lazy housekeeping. “They don’t move anything around, everything is in the sink or the garbage.”

But you don’t have to descend into bachelor habits to defeat contagion. Gerba advises heavy reliance on paper towels. If you don’t want to stockpile disposable towels, wash and dry cleaning tools at high temperatures so your house is clean and germ-free.

Examine Product Claims Closely

There’s a lot of goods that tout themselves as “anti-bacterial” on the label, from floor tile and paint, to hand cleanser and magic markers. The Environmental Protection Agency has a list of 500 products that disinfect hard, non-porous, surfaces against flu. It includes common household cleaners such as Pin Sol, Clorox, and Lysol. Look for the word “disinfect” or “sanitize” on the label; that means the EPA has tested and approved its germ killing power.

Some alternatives such as lemon juice, tea tree oil, oregano oil, or lavender oil have properties that kill microbes. But according to University of Arizona microbiologist Charles Gerba, these natural alternatives often work more slowly, impact a smaller spectrum of microorganisms, and kill fewer of them than products that have passed muster with the EPA.

Put It In the Wash

Modern technology can help do the disinfecting for you through powerful cleaning. If you’re already shopping for appliances, take a look at the list of household appliances cited by the NSF (formerly the National Sanitations Foundation). The group has certified dozens of germ-fighting appliances, including dryers, dishwashers, and washing machines.

Make Handwashing Fun

There are at least six occasions each day when children should wash their hands. So the Visiting Nurses Associations of America, in partnership with the Clorox Company and Families Fighting Flu, Inc. has launched a program to help people ward off the virus. They created a handy refrigerator chart to get children involved in proper handwashing. It teaches them to keep track of all the daytime activities when handwashing is important: before mealtime, before playing with babies, after playing with friends, after coming home from school, after using the bathroom, and, of course, after every cough or sneeze.

Pick Your Cutting Board

While the question of whether wood or plastic is a cleaner surface for a cutting board is more about food-borne pathogens than about flu virus, it’s worth noting that germs of any kind can live on either one. And food poisoning is as much an issue these days as the flu.

So which is safer? The Food Safety Laboratory at the University of California at Davis is leaning toward wood. Plastic cutting boards can go right in the dishwasher, a virtue that’s won favor among many germ slayers. But if you are washing by hand, a knife-scarred plastic cutting board holds onto bacteria, and wooden cutting boards do not. Robert Donofrio, Director of the microbiology laboratories at NSF, says to be safe, have one board for veggies and another for meat. Plastic boards must be washed in a dishwasher. Wooden boards should be made of hard, closely-grained woods, such as maple.

Think Copper

Bacteria and viruses can live about twenty minutes on your sleeve or couch cushion. But they can live a couple of days on the countertop, or other hard, non-porous, surfaces…unless that surface is copper. The EPA has approved copper and copper alloys, such as bronze and brass, as a bacteria killer, and ongoing research suggests it has anti-viral properties, as well.

These days it’s not hard to find copper sinks for the bathroom or kitchen, or even doorknobs and switch plates in the trendy metal. Or go vintage and pull out that classic brass hardware for your home.

Humidify

Some scientists believe an increase in humidity can make it harder for viruses to thrive and multiply, and using a humidifier can help create this inhospitable environment for the flu.

But be careful; humidifiers can breed bacteria. Individual units must be cleaned regularly, and a whole house system serviced yearly—preferably when it’s deactivated in the warmer months, says Barney Burroughs, President of Building Wellness Consultancy and former president of The American Society of Heating, Refrigerating and Air Conditioning Engineers.

Honeywell TrueSTEAM Humidification System, about $550 to $900

Find out more from Health.com about how humidifiers can help beat the flu.

Go Ultraviolet

Air purification can make a small amount of difference in stalling viruses, according to Burroughs, though few strategies offer complete protection. While bacteria, pollen and allergens are airborne risks, viruses mostly spread by touch.

However, ultraviolet air purification systems do keep mold and fungi, both of which can aggravate the flu, from developing in your heating and cooling system.

Honeywell TrueUV Ultraviolet Treatment System, about $285

Be Bullish on Air Filtration

The most benefit you can get from technology comes from air cleaners. Modern filters mostly catch larger particles such as bacteria, pollen, mold spores, but any virus traveling on a larger host can get caught by the filter. “It’s not a see all, fix all. It will reduce, but not eliminate exposure,” says Burroughs.

There’s one caveat, though: The system must be working 24/7 to be effective. “It only works if the fan is blowing,” says Burroughs. When properly used, a system like Honeywell’s Electronic Air cleaner captures 99 percent of the larger particles, and some of the smaller particles, too. And that’s one good way to keep the flu virus from spreading in your home.

Honeywell F300 Electronic Air Cleaner, about $955 to $1280.

After you’ve flu-proofed your house, take things one step further with secrets from women who never get sick from Health.com.

Budget Fixes for Drafty Windows

January 9th, 2013Keeping your home warm doesn’t come at a high price, thanks to these easy-to-do fixes. Bring on the Heat!

Elsa Satella • This Old House magazine

On average, 10 to 25 percent of a home’s heat escapes through its windows. If you’re feeling drafts, you should consider reglazing or even replacing your windows. But if you can’t because of time—or budget—first weatherstrip, then try these other temporary fixes to help beat the chill.

Plastic Film

Applied to panes with double-sided tape and sealed using the heat from a hair dryer, this inexpensive clear shrink film can allow a room to retain as much as 55 percent of its heat. In a pinch, bubble wrap makes an effective replacement; just push the bubble side of the wrap against the glass and adhere with double-sided tape.

Shown: Duck Crystal Clear Shrink Film, about $13 for two 3-packs, My Brands.

Draft Snakes

Stop cold air from creeping through windowsills with a snake. You can buy one online, or easily make one yourself by filling a tube of fabric, like an old knee sock, with dry rice.

Shown: Window and door draft stopper, about $10, Improvements

Rigid Foam

For basement and attic windows you don’t need to see out of, cover the panes with a piece of foam board glued to ⅜-inch drywall. Cut pieces to fit snugly inside the frame, press the foam side against the glass, then simply pop out when you want to let in sunlight.

Shown: Dow ½-inch polyisocyanurate rigid foam sheathing, about $12.50 per 8-4-foot panel, Lowe’s

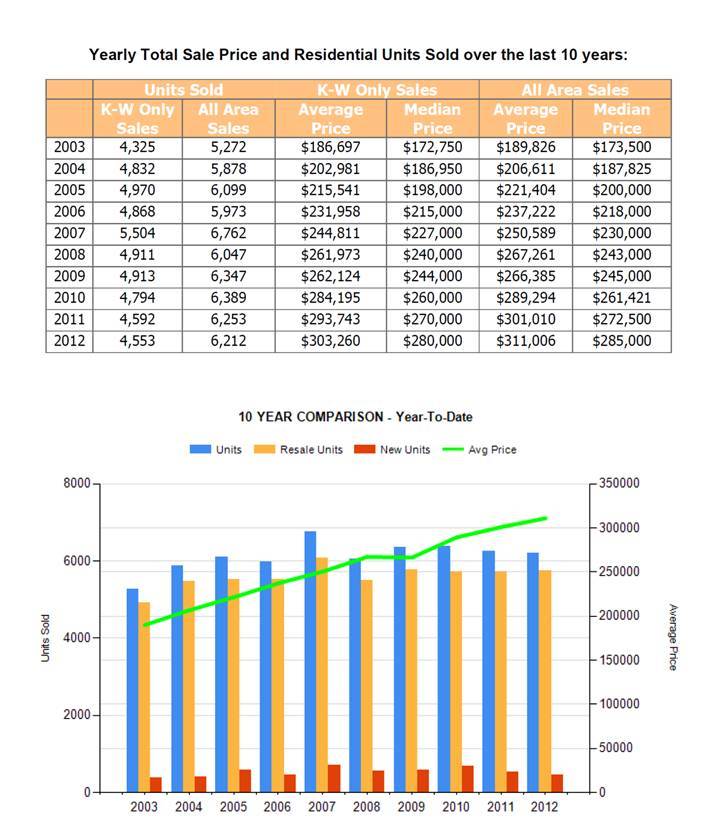

Home Sales In Kitchener-Waterloo Steady In 2012

January 7th, 2013By Kitchener-Waterloo Association of REALTORS® (KWAR) admin •January 4th, 2013

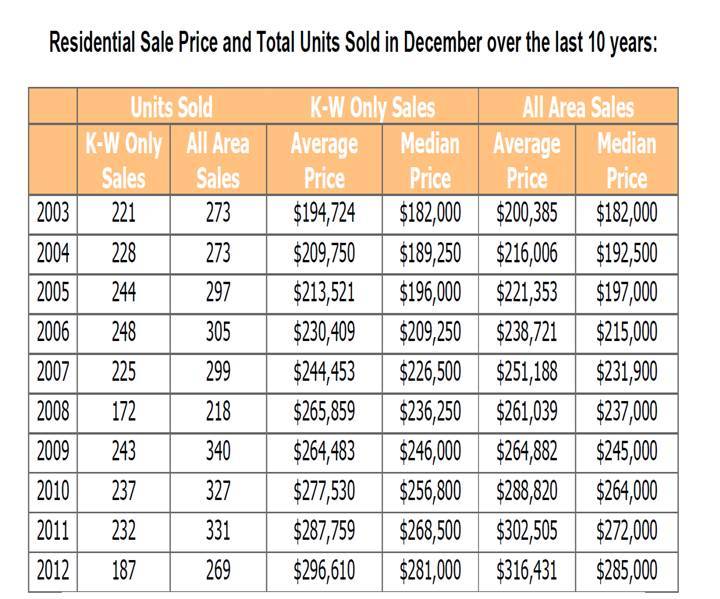

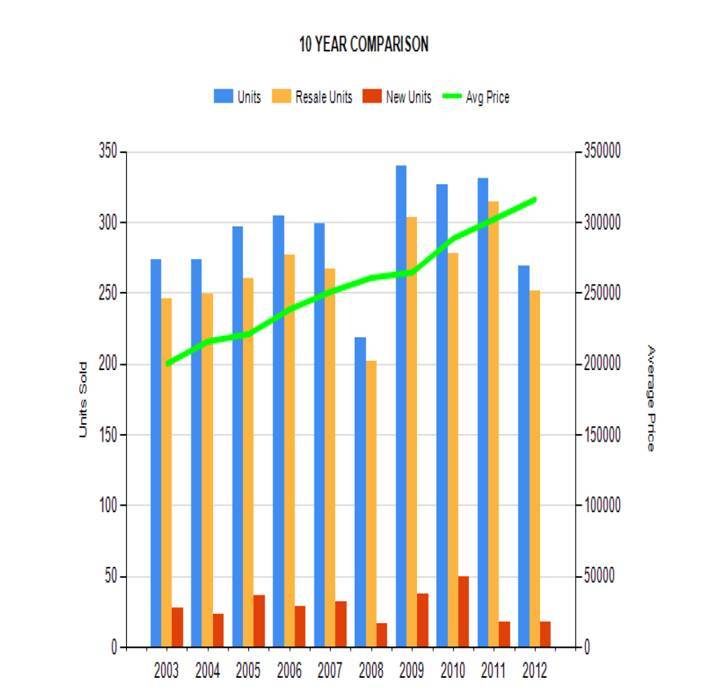

KITCHENER-WATERLOO, ON (January 4, 2013) –– There were a total of 6,212 residential sales through the Multiple Listing System (MLS®) of the Kitchener-Waterloo Association of REALTORS® (KWAR) in 2012, a slight decline of 0.7 percent compared to 2011’s year-end results.

Coming off two consecutive months of strong housing activity in October and November, fourth quarter home sales were practically on par with last year’s results. A total of 1,268 homes sold through the last 3 months of 2012, 6 transactions more than the same period in 2011.

Dollar volume of all residential real estate sold last year increased 2.6 percent to $ 1,931,345,147 compared with 2011, reflecting the steady price gains realized in 2012.

The average sale price of all homes sold in 2012 increased 3.3 percent to $311,006. Single detached homes sold for an average price of $353,888 in 2012, an increase of 3.2 percent. In the condominium market the average sale price in 2012 was $213,520, a 4 percent increase compared to the previous year.

“Residential sales activity remained fairly steady throughout 2012,” says Dietmar Sommerfeld, president of the KWAR. “In July the government put in place tighter mortgage lending rules, which is perhaps partly responsible for the slight easing of demand we saw, but overall the Kitchener-Waterloo housing market continues to show its stability.”

Home sales in 2012 included 4,070 detached homes (down 1.2 percent from 2011), 1,200 condos (down 0.1 percent) 486 semis (down 2.4 percent), and 400 townhouses (up 7.8 percent).

Sommerfeld says that Waterloo region benefits from a very diverse and dynamic economy that will continue to support a healthy housing market and consumer appetite for home ownership in 2012.

The KWAR cautions average sale price information can be useful in establishing long term trends, but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is based on the total dollar volume of all residential properties sold.

Consumers uncertain about current market conditions should work with a REALTOR® to develop an effective selling strategy. If you are buying, a REALTOR® will negotiate on your behalf and guide you through every step. A REALTOR® understands the local market and must, by law, look after your best interests.

Happy New Year!

December 31st, 2012Merry Christmas From The Riz Team

December 21st, 2012GTA new home sales fall 38%

December 20th, 2012November condo sales in the GTA fell 59 per cent from the same month last year

DAVID COOPER/TORONTO STAR

By Susan Pigg | Wed Dec 19 2012While all eyes were looking skyward for fallout from the GTA’s softening condo market in November, sales of new single-family homes plummeted to lows not seen since the recession, as prices soared almost 17 per cent year over year, according to a new study.

Total new home and condo sales to the end of November this year were 16 per cent below the long-term average across the GTA. But the biggest decline — some 38 per cent — has been in the sale of detached, semi-detached and townhouses, according to a report released Wednesday by market research firm RealNet Canada.

Condo sales were down just seven per cent over historic averages for November — although they fell a whopping 59 per cent compared to the same month in 2011, the tail end of what was record year of 28,000 new condo sales across the GTA.

Three new condo launches in particular buoyed highrise sales numbers this November, says RealNet, led by Tridel’s Ten York project in the waterfront area, which is considered an important bellwether of the softening market. Some 85 per cent — 596 of 694 — of its preconstruction units put up for sale Nov. 3 sold within the month, says Tridel vice president Jim Ritchie.

The RealNet study provides some of the best evidence yet of the growing gap between what’s become, just since 2011, the tale of two housing markets across the GTA — new condos and new low-rise homes, which includes detached, semi-detached and townhouses.

The average price of low-rise homes hit a record $625,473 in November, while new condos averaged $437,264, says RealNet.

While the gap between houses and condos has traditionally averaged about $78,000, it has soared to $188,000, largely just in the last 18 months, says George Carras, president of RealNet, which provides new housing market analysis for the Building Industry and Land Development Association (BILD.)

“Sales of low-rise homes in November were the worst on record next to the gloom of November 2008, when we weren’t sure if the world’s financial system was going to hold together or not,” says Carras, citing scarcity for the fact that prices soared to the point that they, combined with tighter mortgage rules, pushed down sales in November.

The scarcity includes a shortage of develop-ready land for new subdivisions caused by a lack of municipal roads, sewers and other infrastructure, as well as the fact that thousands of hectacres of future-growth areas within the provincial greenbelt are tied up in disputes at the Ontario Municipal Board, says Carras.

That supply pressure, at the same time the GTA is seeing a “mini baby boom” among echo boomers, could push up new home prices an average 15 per cent a year, says Bryan Tuckey, president and CEO of BILD.

“In Vancouver, the gap has grown to $700,000 between a condo and a detached house. Vancouver is about 15 years ahead of Toronto in terms of the maturity of its intensification policies and their impacts,” says Carras.

“That city is between the water and the mountains. Here we’re between the water and policy mountains and the same impact is starting to show.”

But John Stillich, former executive director of the Sustainable Urban Development Association, says too many developers remain fixated on the two extremes of new housing — high- and low-rise — instead of a new middle ground of two- or three-storey housing types that allows GTA residents to “live sustainably on the lands that we do have.”

“It’s not about a scarcity of land. It’s about how you use the land. The development industry could probably build twice as many ground-related houses if they started thinking in a completely different way.”