HOME SALES HEAT UP IN MAY

Wednesday, June 5th, 2013By Kitchener-Waterloo Association of REALTORS® (KWAR) admin •June 5th, 2013

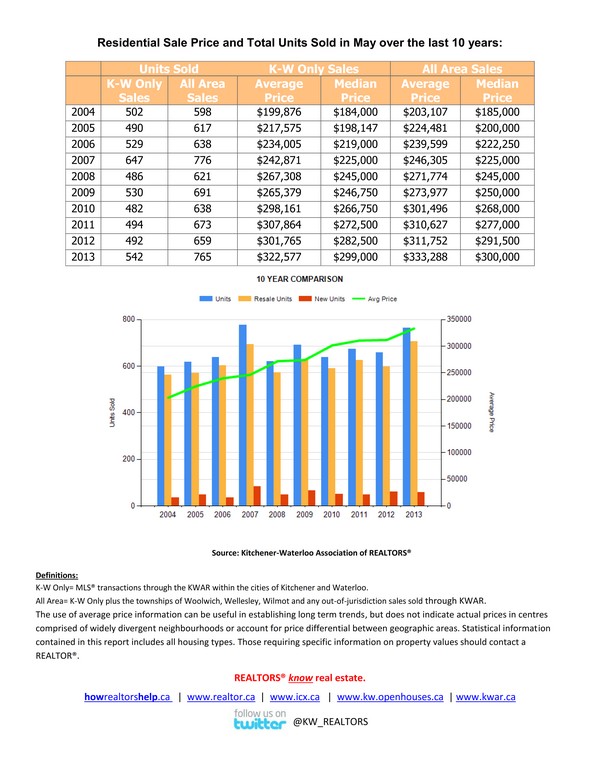

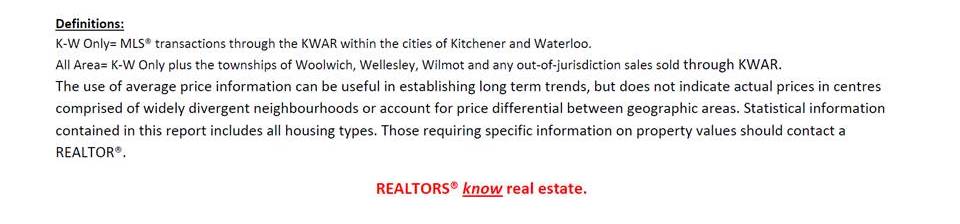

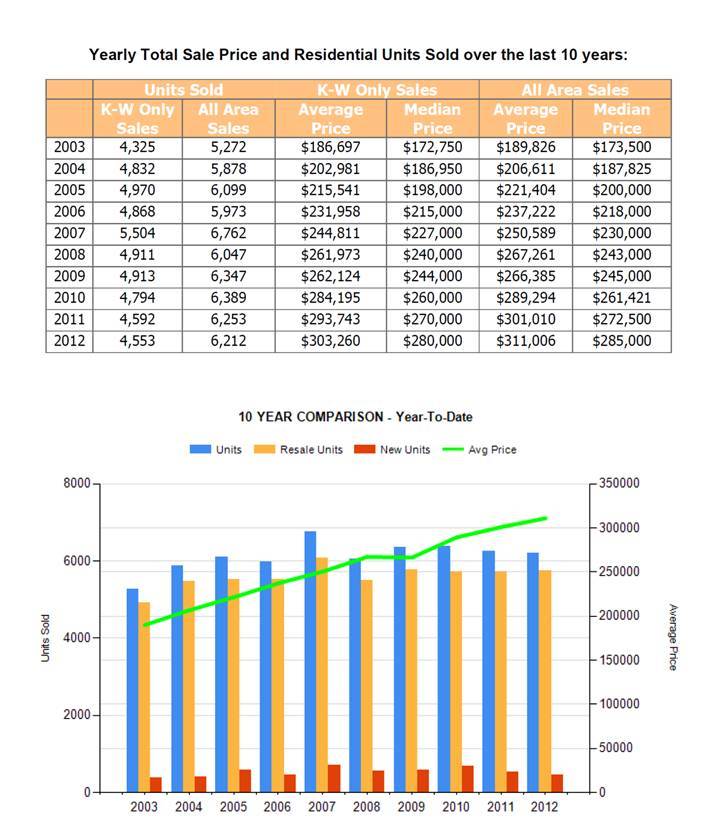

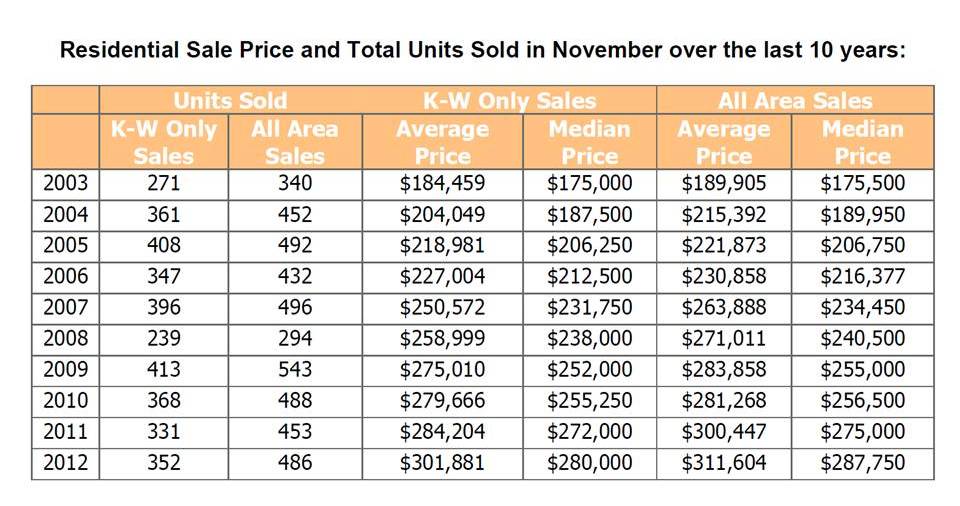

KITCHENER-WATERLOO, ON (June 4, 2013) –– Residential property sales through the Multiple Listing System (MLS® System) of the Kitchener-Waterloo Association of REALTORS® (KWAR) in May were up 16.1 per cent compared to the same time last year. Led by strong sales of single detached homes, it’s the first time sales have surpassed the 700 unit mark in the Month of May since 2007.

A total of 765 residential properties were sold in the month of May compared to 659 the same time last year. Comparing the 5-year average for the month of May shows a 16.3 per cent jump in activity this past month. Year-to-date sales are practically on par with the same time last year nudging up by six residential sales.

“Waterloo region’s residential real estate market was alive and well in May, says Dietmar Sommerfeld, President of KWAR. “On a year-to-date basis, we are seeing sales activity that is right in line with last year’s results and a little above the 5 year average.”

May’s sales included 528 single detached homes (up 17.9 % from last year) 122 condominium units (up 2.5 %), 59 semi-detached (up 20.4 %) and 45 freehold townhouses (up 18.4 %). Year-to-date residential sales were 3.5 per cent above the 5-year average with a total of 2,860 units to date.

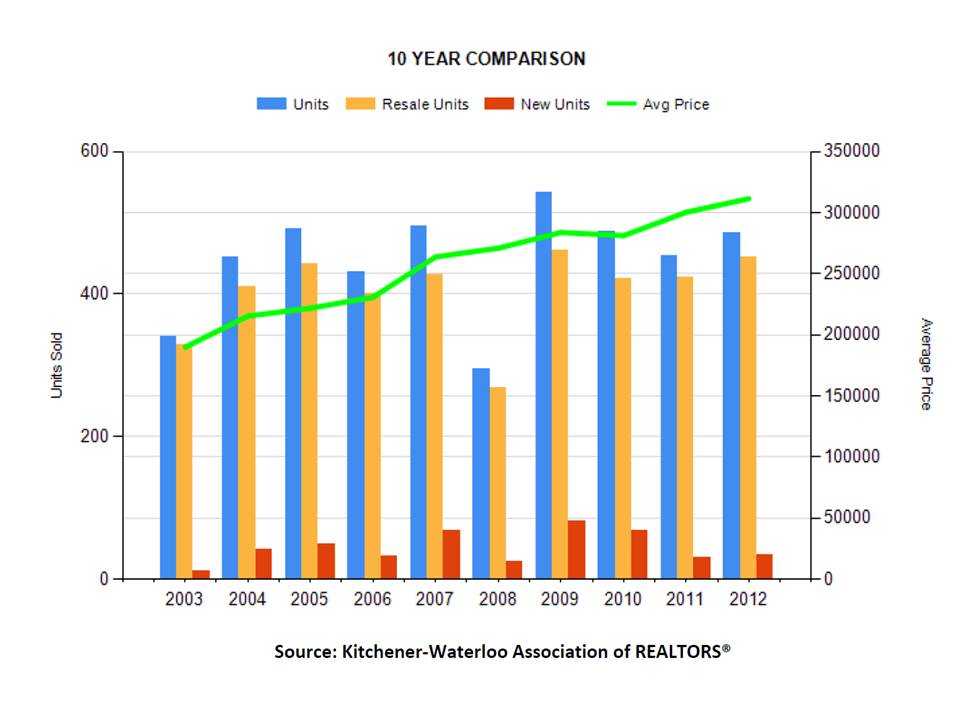

The average sale price of all residential sales through the KWAR’s MLS

® System increased 6.9 percent last month to $333,288 compared with May 2012. Single detached homes sold for an average price of $378,473 an increase of 7.4 per cent compared to last year. The average sale price for a condominium was $212,638, an increase of 3.8 percent compared to May 2012.

“The spring home buying season was in full swing in May,” says President Sommerfeld. “This was reflected in the strong price gains and is a sign of the confidence that homebuyers have in the local housing market and Waterloo region as a great place to live and invest.

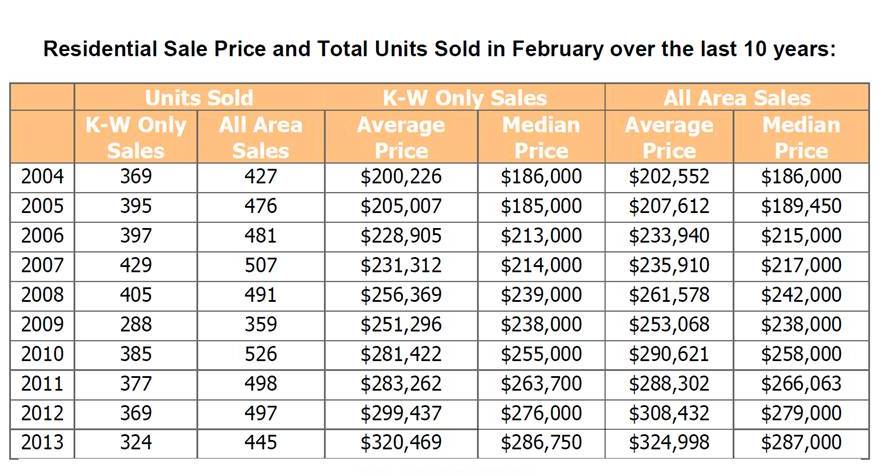

The KWAR cautions that average sale price information can be useful in establishing long term trends, but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. Those requiring specific information on property values should contact a local REALTOR®.