Archive for the ‘Real Estate News’ Category

January’s Deep Freeze Slows Overall Home Sales

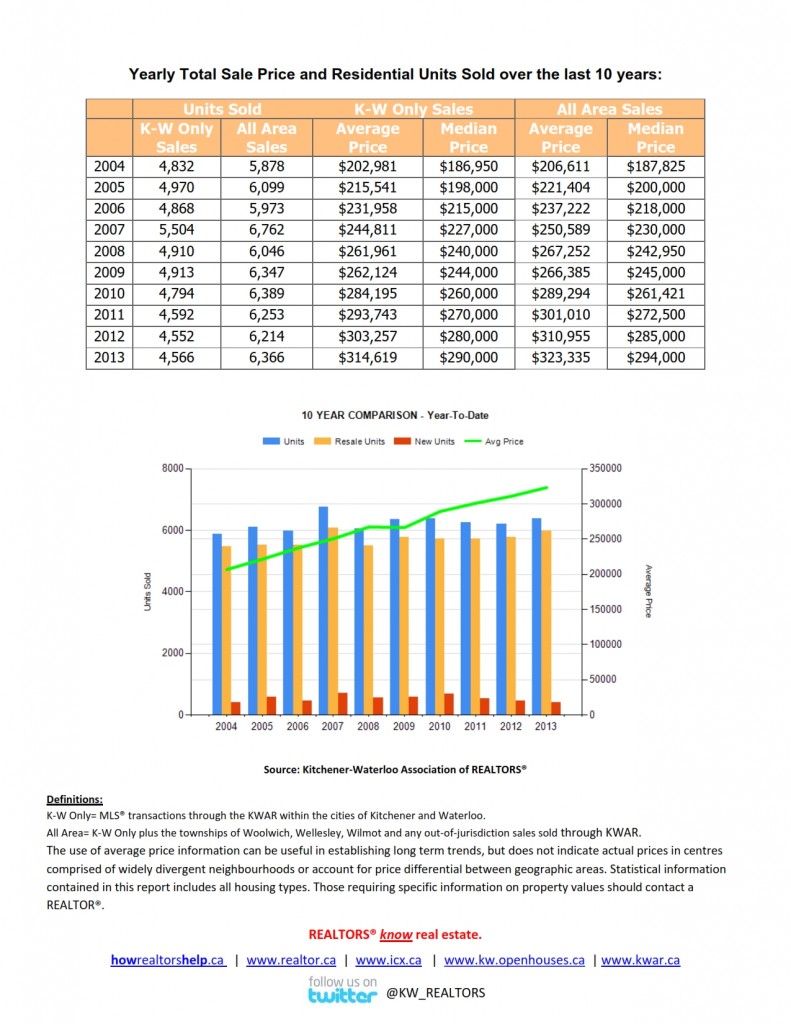

Friday, February 7th, 2014More Homes Sold In 2013 Than The Previous Two Years

Tuesday, January 7th, 2014Happy Holidays

Friday, December 20th, 2013$17,500 Raised For The Foodbank

Friday, December 20th, 2013Featured Properties November 22-28th

Friday, November 22nd, 2013Featured Properties October 18th-24th

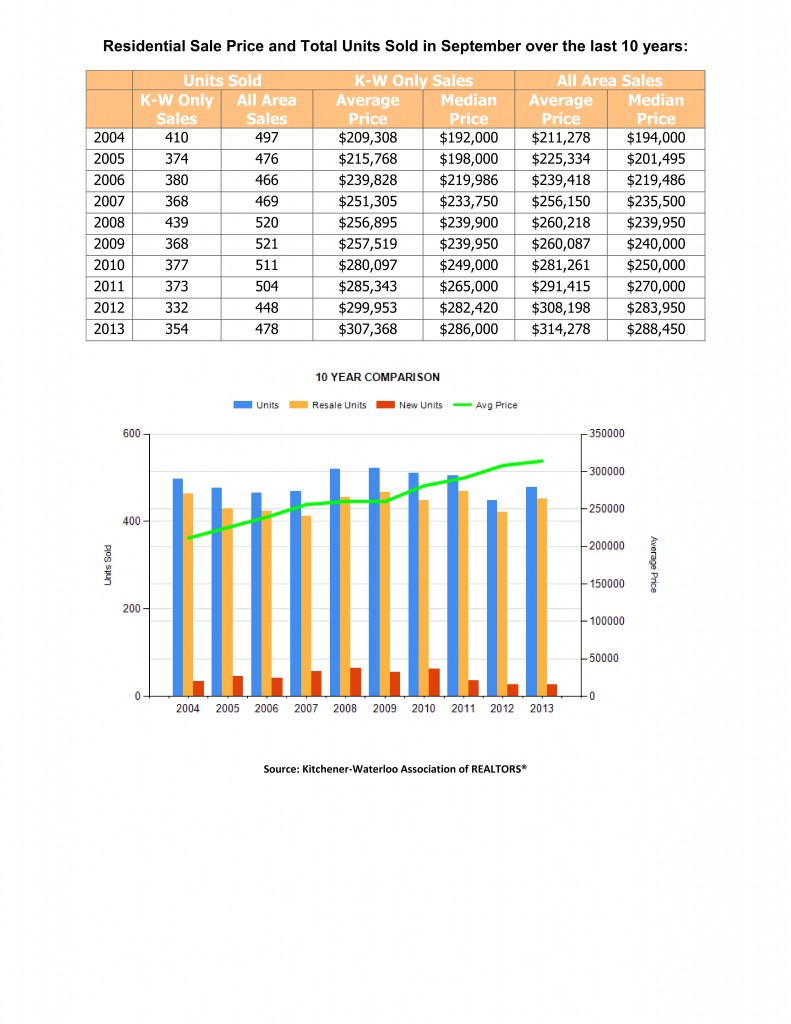

Friday, October 18th, 2013September Sales Remain Strong

Friday, October 4th, 2013By Kitchener-Waterloo Association of REALTORS® (KWAR) admin •October 3th, 2013

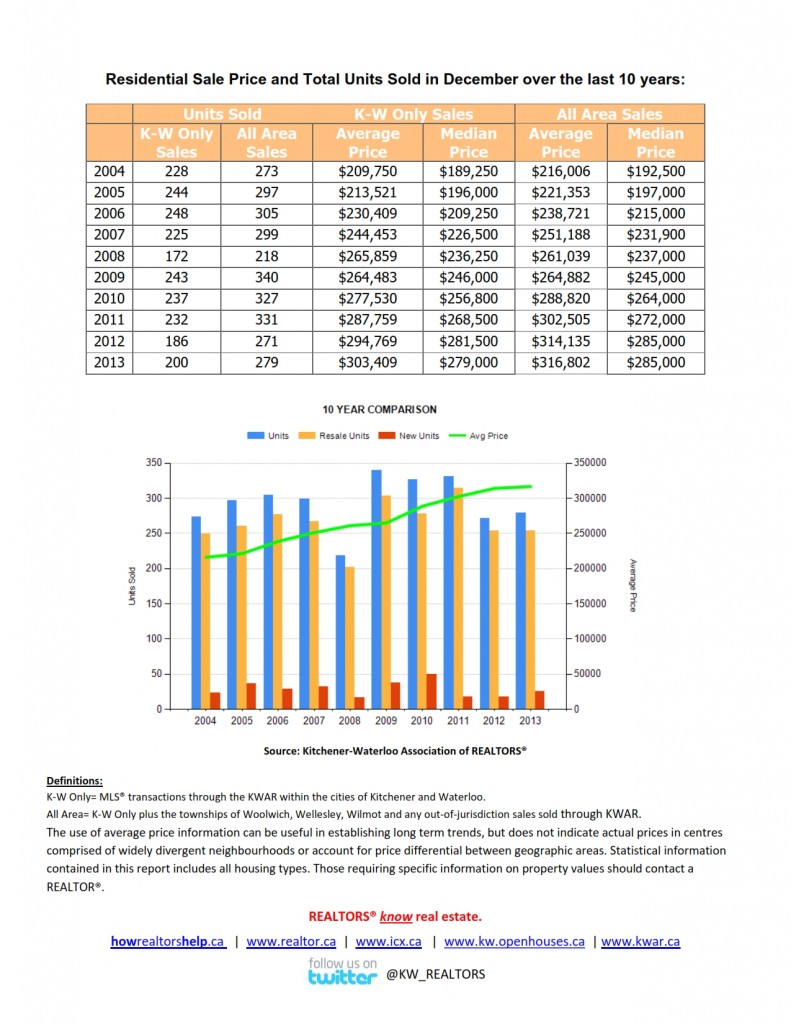

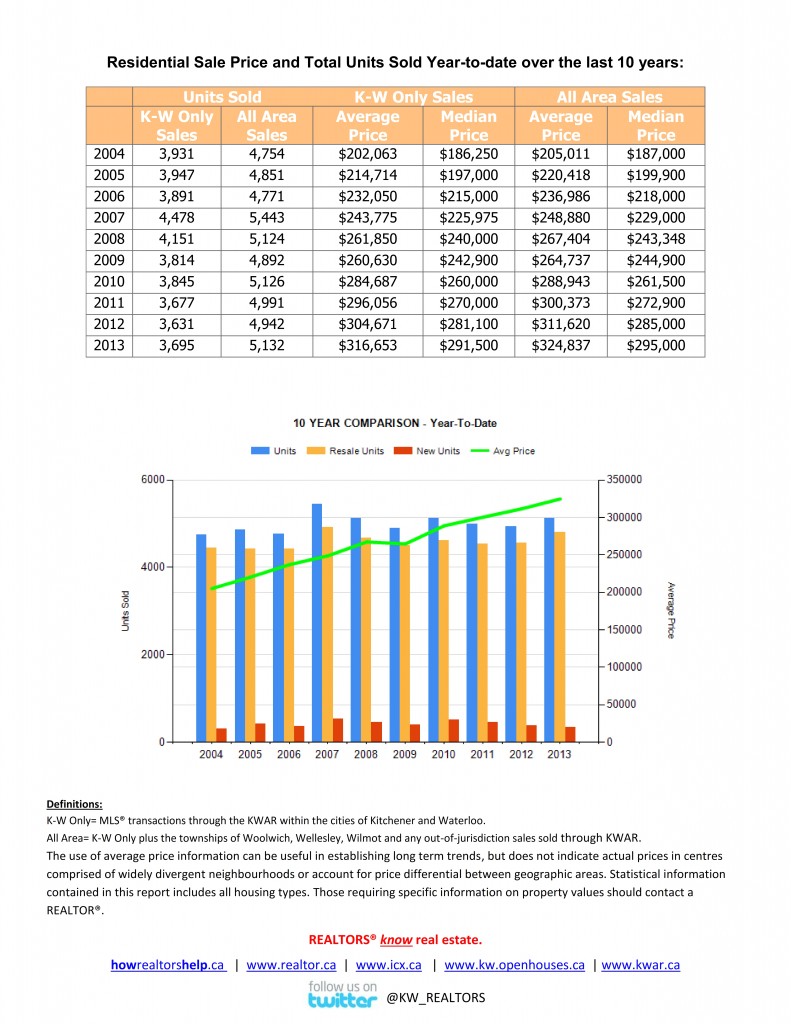

There were are total of 478 home sales through the Multiple Listing System (MLS®) of the Kitchener-Waterloo Association of REALTORS® (KWAR) in September compared to 448 during the same period in 2012, an increase of 6.7 percent. Year-to-date 5,132 homes were sold, which is the highest number of units sold to the end of the third quarter since 2007’s record breaking year when sales had reached 5,443 to the end of September.

Single detached homes in September sold for an average price of $354,507 an increase of 1.8 percent compared to last year. The average sale price for a condominium was $221,810 a decrease of 1.4 percent compared to September of last year. The average sale price of all residential sales through the KWAR’s MLS® System increased 2.0 percent to $314,278 compared to September 2012.

“We’re continuing to see strong residential activity in the Region,” said Dietmar Sommerfeld, President of KWAR. “This reinforces the diversity of our economy and the appeal of the Region as a place to live and work.”

Residential sales in September included 310 single detached homes (up 6.9% from last September), 46 semi-detached (up 17.9%), 33 townhomes (up 13.8%) and 83 condominium units (down 2.4%). Dollar volumes for September and year-to-date sales were both at all-time highs with increases of 9.0 percent and 8.3 percent respectively.

The average price of all residential properties sold year-to-date was $324,837 representing a 4.2 percent increase. Single Detached homes increased 3.7 percent to the end of September, bringing up the year-to-date average price to $368,002.

The KWAR cautions that average sale price information can be useful in establishing long term trends, but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. Those requiring specific information on property values should contact a local REALTOR®.

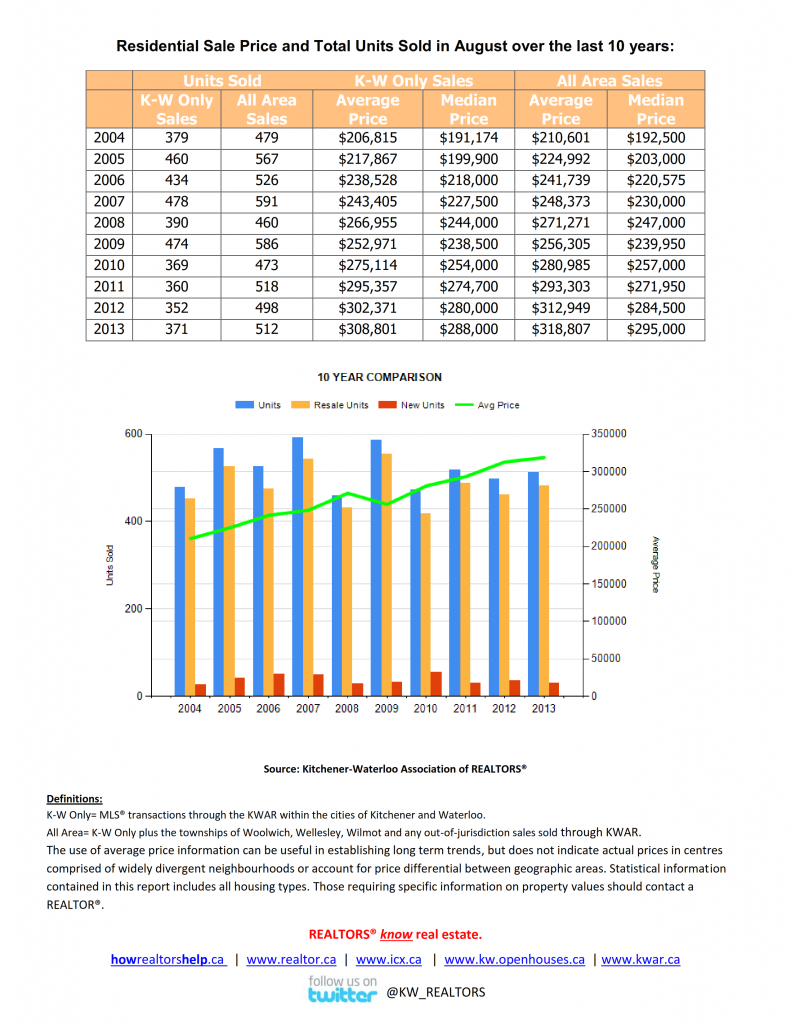

HOMES SALES REMAIN STEADY IN AUGUST

Friday, September 6th, 2013By Kitchener-Waterloo Association of REALTORS® (KWAR) admin •September 6th, 2013

There were are total of 512 home sales through the Multiple Listing System (MLS®) of the Kitchener-Waterloo Association of REALTORS® (KWAR) in August, an increase of 2.8 percent compared to 498 homes sold in the same month last year.

Homes sales were also up on a year-to-date basis with a total of 4,648 units sold, up 3.4 percent from the same time last year. The number of units sold year-to-date is the highest volume of units sold when comparing to sales in the last five years.

“We saw strong residential activity this summer season and with record setting year-to-date sales it’s clear that buyers remain confident about the value of homes in Kitchener-Waterloo,” says Dietmar Sommerfeld, President of KWAR.

Residential sales in July included 346 single detached homes (up 7.1% from last August), 37 semi-detached (up 2.8%), 22 townhomes (down 38.9%) and 101 condominium units (up 3.1%). Home sales in the $275,000 to $399,999 range increased by 18.8 percent this August an accounted for 40 percent of residential sales this month.

Single detached homes sold for an average price of $359,291an increase of 1.8 per cent compared to last year. The average sale price for a condominium was $223,114, a decrease of 3.3 percent compared to August of last year. The average sale price of all residential sales through the KWAR’s MLS® System increased 1.9 per cent to $318,807 compared to August 2012.

The KWAR cautions that average sale price information can be useful in establishing long term trends, but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. Those requiring specific information on property values should contact a local REALTOR®.

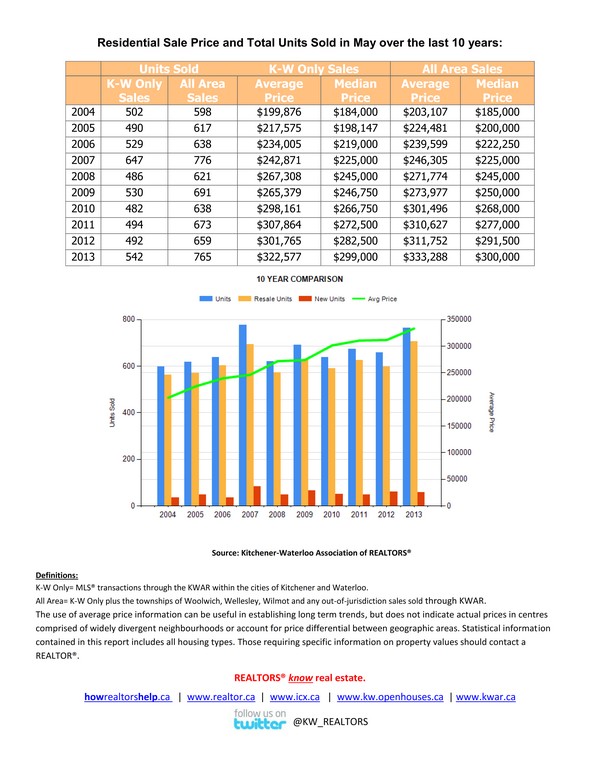

HOME SALES HEAT UP IN MAY

Wednesday, June 5th, 2013By Kitchener-Waterloo Association of REALTORS® (KWAR) admin •June 5th, 2013

KITCHENER-WATERLOO, ON (June 4, 2013) –– Residential property sales through the Multiple Listing System (MLS® System) of the Kitchener-Waterloo Association of REALTORS® (KWAR) in May were up 16.1 per cent compared to the same time last year. Led by strong sales of single detached homes, it’s the first time sales have surpassed the 700 unit mark in the Month of May since 2007.

A total of 765 residential properties were sold in the month of May compared to 659 the same time last year. Comparing the 5-year average for the month of May shows a 16.3 per cent jump in activity this past month. Year-to-date sales are practically on par with the same time last year nudging up by six residential sales.

“Waterloo region’s residential real estate market was alive and well in May, says Dietmar Sommerfeld, President of KWAR. “On a year-to-date basis, we are seeing sales activity that is right in line with last year’s results and a little above the 5 year average.”

May’s sales included 528 single detached homes (up 17.9 % from last year) 122 condominium units (up 2.5 %), 59 semi-detached (up 20.4 %) and 45 freehold townhouses (up 18.4 %). Year-to-date residential sales were 3.5 per cent above the 5-year average with a total of 2,860 units to date.

The average sale price of all residential sales through the KWAR’s MLS

® System increased 6.9 percent last month to $333,288 compared with May 2012. Single detached homes sold for an average price of $378,473 an increase of 7.4 per cent compared to last year. The average sale price for a condominium was $212,638, an increase of 3.8 percent compared to May 2012.

“The spring home buying season was in full swing in May,” says President Sommerfeld. “This was reflected in the strong price gains and is a sign of the confidence that homebuyers have in the local housing market and Waterloo region as a great place to live and invest.

The KWAR cautions that average sale price information can be useful in establishing long term trends, but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. Those requiring specific information on property values should contact a local REALTOR®.