Waterloo Region Housing Market Expected to Pick up Later Next Year

November 28th, 2012The Waterloo Region can expect “slow but steady” growth into 2013

Rose Simone, Record staff

WATERLOO REGION — It has been a year of doom and gloom, with Europe in a recession, the United States facing a “fiscal cliff” and tighter mortgage rules putting a damper on housing market in cities like Toronto and Vancouver.

But Waterloo Region’s housing market is doing relatively well, a housing market outlook conference was told Thursday.

The market is somewhat softer than it was at the beginning of the year, but should pick up a bit later next year, analysts from the Canada Mortgage and Housing Corp. told real estate agents and home builders at the event at Bingemans.

“I think we have seen, especially in the resale market, the slowest part,” said Erica McLerie, an analyst with the corporation. “The new mortgage rules were introduced in July, so that has already impacted the markets, and as we move through 2013, especially with employment growth, that will support housing demand.”

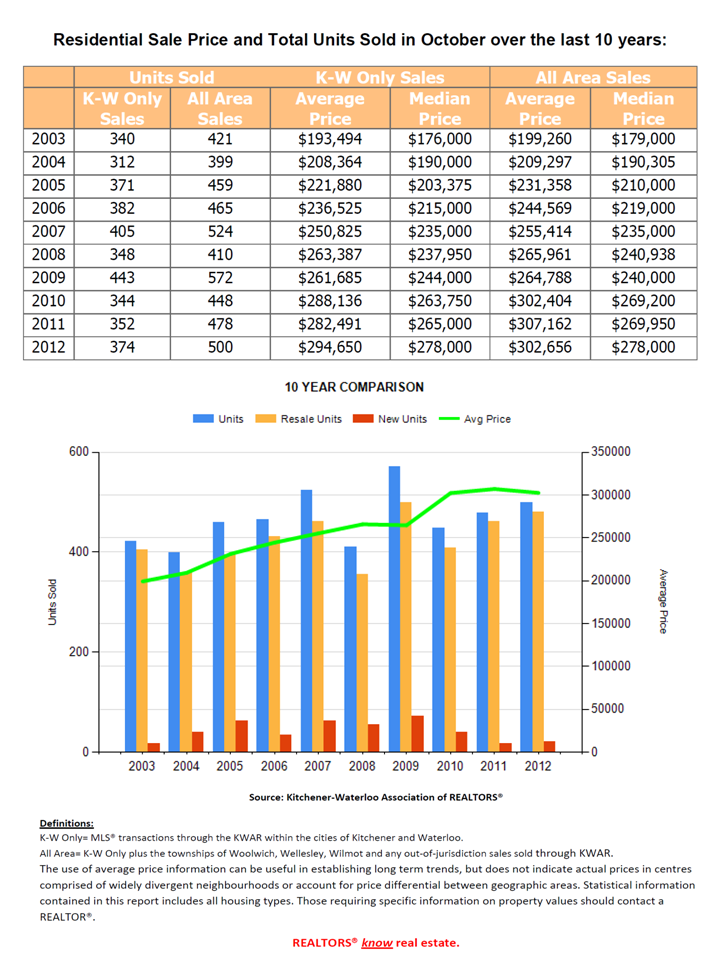

The corporation expects that 6,450 resale homes will change hands in 2013 while 2,900 new homes will be built. Those numbers are a bit lower compared to this year, but the good news is that prices in Waterloo Region should remain steady, instead of declining, as is happening in other markets, McLerie said.

Ed Heese, another analyst with the corporation, said the U.S. economy is turning the corner with growing consumer confidence and rising house prices. Vehicle sales in the U.S. are rising, which will help out manufacturing and the employment picture in Waterloo Region, he said.

As a result, he expects “slow but steady” improvement in the local housing market next year.

The corporation also presented research about the home features that have the biggest impact on home prices. A finished basement has very little impact on price, said McLerie. But homes with green features, central air and those located close to post-secondary institutions are the ones that generate higher prices.

The corporation stressed, however, that construction of single detached homes is slowing down, while demand for apartments and condominiums is rising.

There were fewer couples with children in the 2011 census compared to the 2006 census, and that’s the group that is most likely to buy single-detached homes, McLerie said.

An increase in the number of immigrants in the region and a growing boomer population that has more middle-aged people living alone means there will be greater demand for apartments, she said.

Most of the apartments are being built in downtown areas, in keeping with Waterloo Region’s strategy of trying to intensify core areas, McLerie said.

A concern for the long-term future of the housing market is the 14 per cent unemployment rate for young people. That is slowing down the formation of new households, she said.

“According to the Statistics Canada census, about 42 per cent of people ages 20 to 29 are still living in their parental homes and unless they get good jobs they won’t be able to move into housing of their own, whether in the rental market or the home buying market.”